Funding Simplified

In the fast-paced and competitive world of business, securing adequate funding is often the key to success. However, navigating the complex landscape of funding options can be overwhelming for entrepreneurs and startups. This is where Funding Simplified comes into play, offering a streamlined approach to accessing capital and empowering businesses to thrive.

Definition of Funding Simplified

Funding Simplified refers to a revolutionary concept that aims to simplify the process of obtaining financial resources for businesses and startups. It encompasses various platforms and strategies that eliminate the traditional barriers associated with securing funding, such as extensive paperwork, stringent requirements, and limited accessibility.

Importance of Funding for Businesses and Startups

Funding plays a pivotal role in fueling growth, innovation, and sustainability for businesses at all stages of their development. Whether it’s launching a new venture or expanding an existing one, having access to adequate capital is crucial.

Securing funding allows businesses to invest in research and development, hire skilled professionals, acquire necessary equipment or technology, expand marketing efforts, enter new markets or geographies, and ultimately realize their full potential. For startups specifically, funding is often a lifeline that allows them to transform bold ideas into viable products or services.

The initial stages of any startup journey are typically characterized by uncertainty and risk. Funding provides these ventures with the necessary resources to develop prototypes or minimum viable products (MVPs), conduct market research or feasibility studies before entering full-scale production or commercialization.

Overview of the Benefits of Simplified Funding

Simplified funding offers numerous advantages over traditional funding methods like bank loans or venture capital investments. Firstly, it significantly reduces the time-consuming paperwork typically associated with these processes.

Entrepreneurs can devote more time and energy towards building their businesses instead of being bogged down by tedious administrative tasks. Furthermore, simplified funding approaches broaden accessibility for a wider range of businesses.

Traditional funding methods often favor established companies with strong financial track records or those operating within specific industries. This creates significant barriers for startups and small businesses who may have innovative ideas but lack the financial history or connections to secure traditional funding.

Simplified platforms, like crowdfunding or peer-to-peer lending, democratize the funding landscape, allowing entrepreneurs from diverse backgrounds to showcase their ideas and receive support from a global network of investors. By simplifying the process of obtaining funds and offering increased accessibility, Funding Simplified paves the way for a more inclusive entrepreneurial ecosystem.

It empowers businesses, regardless of size or industry, to access the resources they need to grow and flourish. In subsequent sections, we will delve deeper into the various funding options available within this simplified framework.

Understanding Funding Options

Traditional Funding Methods

Traditional funding methods such as bank loans and venture capital have long been the go-to options for businesses seeking financial support. Bank loans involve a straightforward process where a borrower presents their business plan, financial statements, and collateral to a bank. The bank then evaluates the creditworthiness of the borrower and determines the loan amount, interest rate, and repayment terms.

On the other hand, venture capital involves raising funds from investors who provide capital in exchange for equity or ownership in the business. While traditional funding methods have their merits, they also come with limitations.

One major drawback of bank loans is that they often require extensive documentation and rigorous qualification criteria, making it challenging for small businesses or startups with limited financial history to secure funding. Additionally, banks may demand collateral or personal guarantees from borrowers, which can pose risks in case of default.

Venture capital funding, on the other hand, may be more accessible to innovative startups but often comes with strings attached. Entrepreneurs may face dilution of control and decision-making power as investors become actively involved in shaping the direction of their business.

Alternative Funding Methods

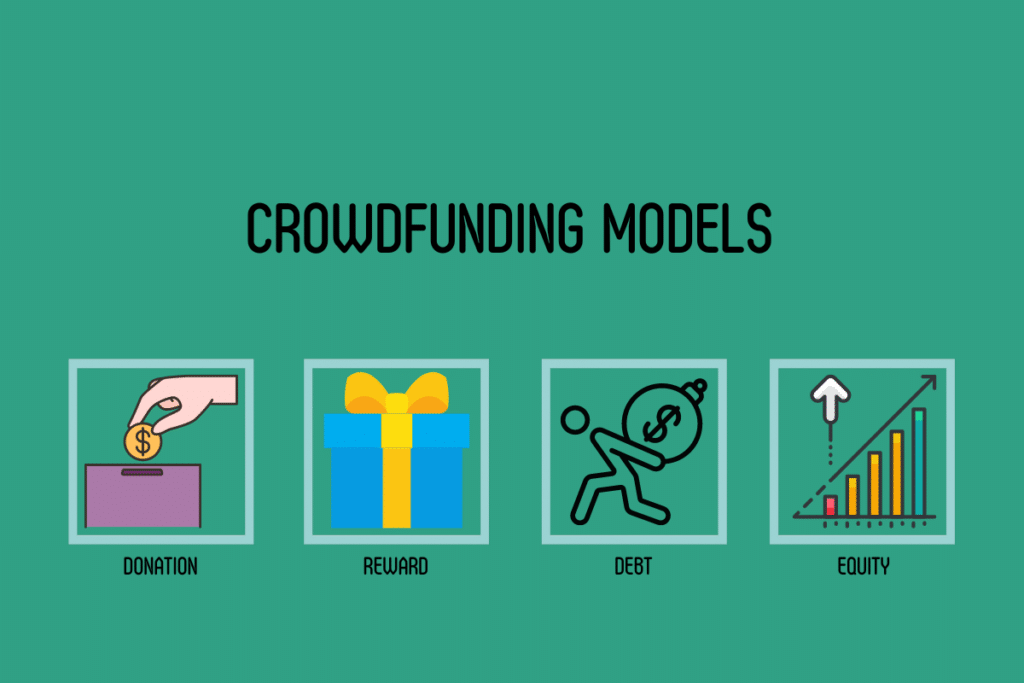

In recent years, alternative funding methods like crowdfunding and peer-to-peer lending have gained significant traction as viable alternatives to traditional funding options. Crowdfunding allows entrepreneurs to raise funds by appealing to a large number of individuals through online platforms.

Reward-based crowdfunding involves offering rewards or pre-sales of products or services in return for monetary contributions from backers who believe in the business idea. Equity-based crowdfunding goes further by offering investors equity shares in exchange for their financial support.

Peer-to-peer lending (P2P) platforms match borrowers directly with lenders through an online marketplace without involving traditional financial intermediaries like banks. P2P lending provides access to funds through individual lenders who evaluate borrowers’ profile based on creditworthiness factors such as credit history, income, and purpose of the loan.

These alternative funding methods present advantages over traditional options. Crowdfunding allows entrepreneurs to tap into a broader network of potential investors, expanding their reach beyond traditional funding sources.

It also acts as a validation tool for business ideas since successful crowdfunding campaigns demonstrate market demand. Peer-to-peer lending platforms offer a streamlined application process with faster fund disbursement compared to traditional banks.

Moreover, these platforms provide opportunities for borrowers who may not meet the strict requirements imposed by banks to secure loans. However, it is important to note that alternative funding methods also come with certain risks such as regulatory compliance issues and potential lack of investor protection in some cases.

The Rise of Simplified Funding Platforms

Introduction to simplified funding platforms (e.g., online marketplaces)

Simplified funding platforms have revolutionized the way entrepreneurs and businesses access capital. These online marketplaces provide a digital platform that connects borrowers with potential lenders, eliminating the need for traditional financial intermediaries.

By removing the barriers and complexities associated with conventional funding methods, these platforms have opened up new avenues for entrepreneurs to secure the necessary funds they need to bring their ideas to life. These simplified funding platforms operate through user-friendly websites or mobile applications, making it convenient for both borrowers and lenders to engage in the process.

The ease of use is a key feature of these platforms, as they are designed to simplify and streamline the funding experience for all parties involved. Through a few simple steps, entrepreneurs can create profiles, submit loan or investment requests, upload relevant documents such as business plans or financial statements, and connect with potential investors or lenders who are interested in supporting their ventures.

Definition and characteristics of these platforms

Simplified funding platforms can be defined as digital ecosystems that facilitate direct lending or investment transactions between borrowers and lenders without intermediaries such as banks or venture capitalists. These platforms act as matchmakers between businesses seeking financial support and individuals looking to invest or lend money.

Characteristics of these platforms include transparency, accessibility, and efficiency. They provide transparent information about borrowing rates, terms, repayment schedules, and fees so that borrowers can make informed decisions regarding their financing options.

Accessibility is another crucial aspect facilitated by these platforms; they remove geographical limitations by allowing entrepreneurs from anywhere in the world to connect with potential investors globally. Furthermore, simplified funding platforms leverage technology-driven algorithms to efficiently match suitable borrowers with compatible lenders based on criteria such as creditworthiness and risk appetite.

Examples of popular platforms in the market

The growth of simplified funding platforms has led to the emergence of numerous players in the market. Some well-known examples include: 1. LendingClub: LendingClub is a prominent peer-to-peer lending platform that connects borrowers with individual and institutional investors.

They offer personal loans, business loans, and patient financing for healthcare providers. 2. Kickstarter: Kickstarter is a renowned reward-based crowdfunding platform that allows entrepreneurs to showcase creative projects and solicit financial support from backers worldwide.

It has gained popularity in various fields such as arts, technology, design, and gaming. 3. Funding Circle: Funding Circle is one of the leading online marketplace lending platforms focusing on small businesses.

It enables businesses to access loans from individual and institutional investors who are interested in supporting their growth. These examples highlight the diversity of simplified funding platforms available in the market, catering to specific financing needs and preferences of entrepreneurs across different sectors.

Benefits for entrepreneurs seeking funds

Simplified funding platforms offer significant advantages for entrepreneurs seeking funds compared to traditional funding methods: 1. Streamlined application process with reduced paperwork: Unlike traditional lenders or venture capital firms that often require extensive documentation and complex application procedures, these platforms simplify the process by leveraging digital technology.

Entrepreneurs can often complete applications online by providing essential information about their business, reducing paperwork significantly. 2. Increased accessibility for a wider range of businesses: Conventional funding sources may be inaccessible or restrictive based on various factors such as geographical location or industry sector.

Simplified funding platforms break down these barriers by providing opportunities for diverse businesses ranging from startups to small enterprises in niche markets to access capital more easily. By embracing simplified funding platforms, entrepreneurs can leverage technology-driven solutions that streamline the entire financing process while expanding their access to a broader pool of potential investors or lenders who are keen on supporting innovative ventures without conventional red tape.

Crowdfunding Platforms

Rewards-based Crowdfunding Platforms: Igniting Support through Incentives

Rewards-based crowdfunding platforms have revolutionized the way entrepreneurs fund their projects. Operating on the principle of offering incentives to backers, these platforms enable individuals to contribute funds in exchange for exclusive rewards or products. The process typically involves entrepreneurs presenting their project and funding goal on the platform, along with a range of reward tiers corresponding to different contribution levels.

Backers can then choose a tier based on their desired level of support. The advantages of rewards-based crowdfunding are manifold for entrepreneurs.

Firstly, it serves as a validation mechanism, as successful campaigns demonstrate market demand and investor interest in their product or idea. Additionally, crowdfunding acts as an effective marketing tool by generating buzz around the project and attracting potential customers who may become long-term supporters.

Moreover, this approach provides an opportunity for entrepreneurs to engage directly with backers, fostering a sense of community and loyalty that extends beyond financial support. By leveraging the power of collective investment, rewards-based crowdfunding platforms empower entrepreneurs to turn dreams into reality while forging meaningful connections with their target audience.

Equity-Based Crowdfunding Platforms: Pioneering Shared Success

Equity-based crowdfunding platforms offer a distinct twist by enabling investors to receive equity stakes in return for their contributions. This novel approach allows entrepreneurs to raise funds while simultaneously building a base of committed shareholders who share in the potential success of the venture. Equity-based crowdfunding operates through online platforms that facilitate connections between businesses and investors seeking equity opportunities.

Entrepreneurs present detailed business plans and financial projections on these platforms, compelling investors to evaluate potential returns against associated risks before deciding whether or not to invest. For investors, equity-based crowdfunding presents both advantages and considerations.

On one hand, it offers access to investment opportunities that were traditionally reserved for venture capitalists or angel investors, thereby democratizing the investment landscape. Furthermore, investors can diversify their portfolio by investing smaller amounts in multiple ventures.

However, it is crucial to bear in mind that investing in early-stage companies inherently carries risks, such as the possibility of failure or limited liquidity. For entrepreneurs, equity-based crowdfunding provides an alternative to traditional funding sources, allowing them to retain control over their venture while leveraging the expertise and networks of a diverse group of shareholders.

Peer-to-Peer Lending Platforms

Bridging the Gap: Peer-to-Peer Lending Explained

Peer-to-peer (P2P) lending platforms offer a unique solution for entrepreneurs seeking capital outside the traditional banking system. P2P lending operates by connecting borrowers directly with individual lenders or groups of lenders through online marketplaces. By cutting out intermediaries such as banks, these platforms facilitate mutually beneficial lending arrangements.

In P2P lending, borrowers submit their loan applications on the platform along with relevant financial information and creditworthiness assessments. Lenders then evaluate loan requests based on factors such as risk profile and interest rates offered.

Once a match is made between borrowers and lenders willing to fund their loan, funds are transferred directly from lenders’ accounts to borrowers’, establishing a direct lending relationship. The benefits for entrepreneurs considering P2P lending are substantial.

Firstly, this approach offers greater flexibility than traditional loans as terms can be tailored based on specific needs and circumstances. Moreover, P2P lending often results in faster approval times compared to banks’ lengthy verification processes.

Additionally, entrepreneurs with limited credit history or who may not meet stringent bank requirements find P2P lending more accessible and inclusive. By connecting borrowers directly with willing lenders through user-friendly platforms, peer-to-peer lending fuels entrepreneurship by providing an alternative avenue for funding growth and innovation.

Online Marketplaces: Redefining Financial Connections

Uniting Lenders and Borrowers: The Power of Online Marketplaces

Online marketplaces have emerged as transformative platforms that connect lenders and borrowers in a streamlined, digital ecosystem. These marketplaces provide an efficient way to bridge the gap between those seeking funding and those willing to invest by creating a marketplace where lenders can find suitable borrowing opportunities. Online marketplaces function by allowing borrowers to create profiles and present their financing needs.

Simultaneously, lenders can browse through various loan requests based on their investment criteria, such as loan duration, interest rates, credit scores, and purpose of the loan. Once a match is found, borrowers receive the required capital directly from lenders who believe in their business potential.

The advantages of online marketplaces extend beyond convenience. By eliminating traditional banking intermediaries, these platforms often offer lower interest rates for borrowers while providing attractive returns for lenders compared to traditional investment options.

Additionally, online marketplaces promote transparency by providing access to borrower information necessary for informed decision-making. Furthermore, these platforms offer an inclusive environment where small businesses or individuals with innovative ideas can secure funding without facing the same hurdles encountered when dealing with conventional financial institutions.

Conclusion

In a dynamic world where innovation reigns supreme and entrepreneurship thrives on creative solutions, simplified funding platforms have reshaped the landscape of financial support for businesses. Crowdfunding platforms have revolutionized fundraising by engaging backers through rewards or equity stakes while enabling entrepreneurs to validate their ideas and build connections with their audience.

Peer-to-peer lending has provided a compelling alternative to traditional banks by facilitating direct lending relationships between borrowers and individual investors. Online marketplaces have streamlined the process of connecting lenders with worthy borrowers while offering increased accessibility and transparency.

As we embrace these simplified funding methods that empower entrepreneurs worldwide, we witness a democratization of resources previously limited to a privileged few. The barriers that once hindered aspiring innovators are being dismantled brick by brick, fueling a wave of optimism for the future of business.

With funding simplified, opportunities are becoming more accessible, and dreams can transform into reality with renewed vigor and determination. Let us celebrate this evolution in financing, as it paves the way for a vibrant landscape where entrepreneurial spirit thrives and transforms our world for the better.