The Investment Risks you need to know!

In the complex world of finance, investments serve as a beacon of potential profit, drawing individuals and institutions towards promising returns. However, akin to sailing on uncharted seas, investment ventures come bundled with various uncertainties—risks that could cause a turbulent shift in expected outcomes.

Thus, navigating the investment landscape necessitates an in-depth understanding of these risks. As we journey into the intricate fabric of investment risks, it is crucial to keep our focus trained not merely on the enticing prospects of gain but also on comprehending the nuanced layers and dynamics that involve potential losses.

Definition of Investment Risks

The Inescapable Reality: Defining Investment Risks

Investment risks can be aptly defined as the likelihood or probability of losses relative to the expected return on an investment. This essentially encapsulates any deviation from the expected outcome – be it positive or negative. It is an irrefutable part and parcel of any form of financial investment; every investment decision inherently comes with associated risks.

Fundamentally, these risks are fueled by a melange of factors such as market fluctuations, economic shifts, changes in interest rates and inflation scenarios among others. Understanding their nature and scope is indeed paramount for designing risk mitigation strategies.

The Many Faces Of Risk: Differentiating Risks

Further dissecting this term reveals various faces of risk — market risk (equity risk, interest rate risk & currency risk), credit risk, liquidity risk, operational risk and reinvestment risk. Each variant presents a unique challenge and requires specific strategies for successful navigation.

Importance Of Understanding Investment Risks

The Need Of The Hour: Why Understand Investment Risks?

Understanding investment risks is not just an additional cog in the wheel of financial knowledge, it is indeed the lifeblood that fuels informed decision making. It empowers investors to anticipate potential pitfalls, strategize accordingly and thus protect their financial interests. This understanding significantly reduces the probability of facing unexpected negative returns.

Knowledge Is Power: The Implications Of Understanding Risks

With a proper grasp on investment risks, investors are better equipped to align their investment endeavors with their risk tolerance, financial goals and time horizon. It enables them to create a robust investment portfolio that reflects their unique financial landscape. Moreover, understanding risks aids in choosing suitable risk management strategies such as diversification and hedging.

Unveiling the Mysteries: Types of Investment Risks

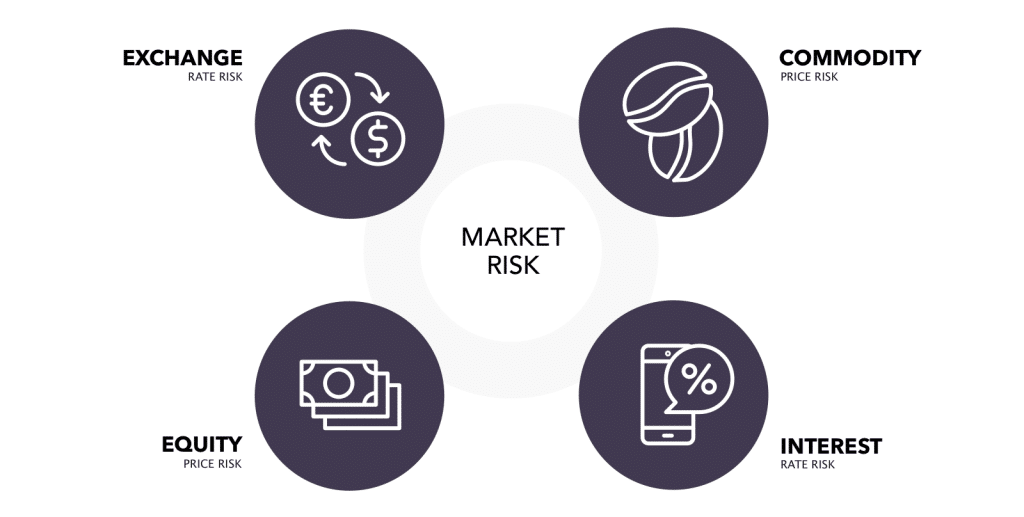

Market Risk: The Unseen Power That Sways Financial Markets

Market risk, often referred to as systematic risk, is an integral part of any investment. This risk type represents the potential for losses in securities trading due to fluctuations in overall market prices. Market events, geopolitical tensions, and financial crises can drastically impact an investor’s portfolio.

There are three primary types of market risks that investors should be acutely aware of: equity risk, interest rate risk and currency risk. These are pivotal considerations when making investment decisions as they could significantly affect your returns.

Equity Risk: The Double-Edged Sword of Stock Investments

The first subtype we encounter under market risks is Equity Risk. It presents itself when there are shifts in stock prices. Equity markets can swing wildly due to various factors – economic indicators, corporate earnings reports or changes in management among others.

Therefore, investing in equities carries the risk that stock prices may decrease after purchase, causing wealth erosion. Beyond individual company performance and sector trends, larger external factors such as changes in government policies or international trade relations can also play a significant role in determining equity risks.

Interest Rate Risk: The Invisible Puppeteer

The second form of market risk that demands our attention is Interest Rate Risk. This refers to the potential negative effects on an investment’s value due to changes in prevailing interest rates which can negatively influence several types of investments but is most commonly associated with bonds. As interest rates rise, bond prices fall and vice versa.

The logic behind this phenomenon is simple yet crucial – when new bonds are issued at higher rates than existing ones; investors will prefer these new issues causing a decline in demand and subsequently the price of existing lower-yield bonds. It’s essential to consider these dynamics when investing in interest rate sensitive instruments.

Currency Risk: The Global Portfolio’s Adversary

Currency risk, or exchange rate risk, is the third type of market risk. It arises from changes in the price of one currency relative to another. Investors who hold investments in foreign countries are subject to currency risk because changes in exchange rates can affect the value of foreign investments.

For example, if an investor based in the United States invests in a European company, a depreciation of the Euro against the Dollar would reduce that investment’s value. Hence, investors with global portfolios should consider hedging this risk if they foresee currency volatility.

Credit Risk: The Enemy Within

Credit Risk is also a significant player within the realm of Investment Risks. It refers to the potential failure by debt issuers and counterparties to meet their obligations as per contract terms.

Simply put, it’s about a borrower defaulting on any type of debt by failing to make required payments. This kind of risk is prevalent mainly when investing in corporate bonds or other forms of credit-based securities but can also appear when dealing with derivative contracts such as swaps where counterparties might not fulfill their commitments.

Liquidity Risk: The Silent Foe

Liquidity Risk surfaces when an asset cannot be bought or sold quickly enough without causing its price to move significantly. This could potentially cause losses for investors who must sell their assets under unfavorable market conditions due to urgent cash needs or other reasons.

The degree of liquidity can vary substantially with factors such as market size and depth, transaction frequency and size along with current market conditions playing key roles. Thus it remains an important consideration especially for large investments or thinly traded markets.

Operational Risk: The Dark Horse

Operational Risk is a type of risk often ignored by investors. It arises from flaws in a company’s day-to-day operations, systems or processes. It can result due to interruptions in the supply chain, labor disputes, fraud, system failures or even regulatory changes.

In essence, any issues that affect a company’s normal functioning are categorized under this risk. Investors should consider operational risk alongside financial risks while evaluating an investment opportunity as it can significantly impact the company’s profitability and value.

Reinvestment Risk: The Fickle Future

The final entrant on our list of significant investment risks is Reinvestment Risk. It speaks to the risk that future cash flows – either coupons (for bonds) or dividends (for stocks) – will have to be reinvested at a potentially lower interest rate.

This occurs when interest rates fall, making it difficult for investors to reinvest their earned income at comparable returns. While bondholders are most visibly affected by this risk given their fixed payments and maturities, holders of dividend-paying stocks are also susceptible when companies decide to cut dividends during lower rate environments.

Detailed Analysis of Each Type of Investment Risks

Understanding Market Risk

Market risk, also known as ‘systematic risk’, is the peril that an investor has to face due to fluctuations in the financial market. It is inherently tied to the macroeconomic factors that can influence entire markets, not just a single stock or industry. For instance, geopolitical events, inflation rates, changes in economic indicators such as unemployment figures and gross domestic product (GDP) can all cause market-wide effects.

Understanding this risk allows investors to anticipate potential losses and take strategic steps to mitigate its impact. A subset of market risks includes equity risk, interest rate risk and currency risk which delve into more specific areas susceptible to losses.

Decoding Equity Risk

Equity risk is primarily associated with price changes in stocks— a dynamic influenced by both micro and macro-economic factors. On the micro level, company-specific events like earnings reports or CEO change can affect stock prices while on a macro level; recessions or government policy changes can impact entire sectors or all companies listed on an index.

Thus, an understanding of equity risks helps investors choose stocks judiciously and build a resilient portfolio. Interest rate shifts are another significant component underpinning investment risks which we will unravel in the next segment.

The Implication of Interest Rate Risk

Interest rate risk reflects the vulnerabilities investments face owing to fluctuations in interest rates. Bonds are particularly susceptible as when interest rates rise; bond prices fall (and vice versa). This inverse relationship between interest rates and bond prices exist because existing bonds may appear less attractive relative to newly issued bonds offering higher yields if rates increase.

This can lead to capital loss for bondholders who need to sell their bonds before maturity. Currency swings pose yet another dimension of investment risks explored below.

Navigating Through Currency Risk

Currency risk, or exchange rate risk, arises due to potential adverse shifts in foreign exchange rates. This risk is particularly relevant for investors who hold investments denominated in a currency different from their own.

For instance, if an investor based in the U.S holds stocks of a European company and the euro depreciates against the dollar, the value of their investment will decrease when converted back into dollars. Next, we move to credit risks that hint at default possibilities.

Unpacking Credit Risk

Credit risk refers to the probability of a debtor (borrower) defaulting on any type of debt by failing to make required payments. Investments in corporate bonds carry credit risk as companies can go bankrupt or face financial hardships preventing them from meeting their debt obligations.

Credit ratings by agencies such as Moody’s and Standard & Poor’s provide guidance on a company’s creditworthiness and associated default risk. The inherent marketability issues bring us to liquidity risks.

Dissecting Liquidity Risk

Liquidity risk represents potential difficulties an investor might encounter while attempting to buy or sell a security due to its lack of marketability. This could arise from a lack of buyers or sellers at any given time for specific investments leading to potential losses if an asset has to be sold quickly but cannot be without significant price reduction. The last segment probes into reinvestment risks linked with future cash flows.

Reinvestment Risk Explained

Reinvestment risk pertains to the possibility that future cash flows—either coupons (for bonds) or dividends (for stocks)—will have to be reinvested at a lower potential interest rate. Suppose interest rates drop around the time bond coupons mature or dividends are paid out; these funds’ reinvestment may not fetch returns equivalent to earlier estimations leading to reduced overall earnings.

Risk Management Strategies

The Power of Diversification

Diversification is a sage strategy often employed to mitigate investment risk. This approach involves spreading your investments across a wide array of assets or asset classes, with the purpose to temper potential losses in one area with gains in another.

The fundamental tenet behind diversification is that markets do not consistently move in sync and different portions of the market can experience contrasting phases. However, it’s important to understand that diversification is not a one-off task, but an ongoing process.

Regular review and rebalancing of the investment portfolio are required as market conditions morph and individual investments stray from their initial allocation. A diversified portfolio can cushion against extreme volatility, safeguarding your financial goals even under adverse market conditions.

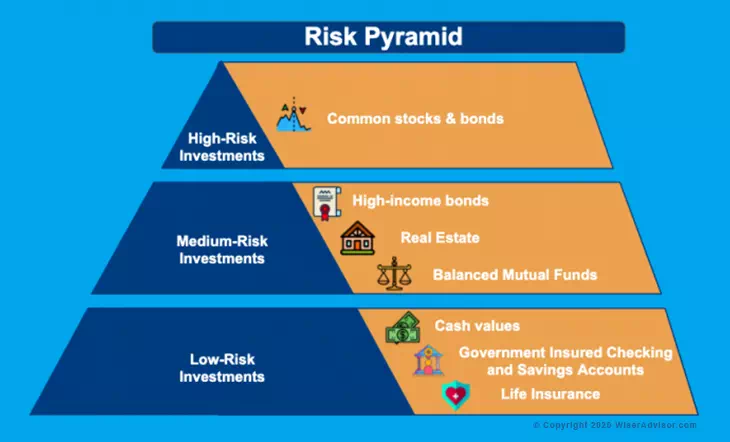

Asset Allocation: Constructing a Balanced Portfolio

Asset allocation signifies proportioning your investments among different varieties of investment categories, such as bonds, stocks, real estate or cash equivalents among others. This technique aims to balance risk and reward by adjusting the percentage of each asset in your portfolio based on your risk tolerance, financial objectives and investment horizon.

The foundation for proper asset allocation lies in understanding the correlation between different asset classes – how they react relative to one another when market dynamics change. Asset distribution should be designed meticulously to ensure that it aligns with investor’s age, financial ability, life-stage requirements and risk appetite.

Hedging: An Insurance Against Market Volatility

Hedging is akin to buying insurance for your investments; it is used as a mechanism to protect against potential losses during uncertain market conditions. It includes various complex financial instruments like options contracts or derivatives which offer investors an opportunity to offset possible negative side effects of certain risky business endeavors.

Hedging is particularly useful in managing market and currency risks. Nevertheless, it’s crucial to note that hedging strategies can be expensive and they do not eliminate risk entirely; instead, they manage and reduce the extent of damage from potential investment losses.

Insurance: Safeguarding Your Investments

Insurance plays a pivotal role in comprehensive risk management strategy. Beyond providing protection against personal or property loss, certain types of insurance products can serve as valuable investment tools. For instance, life insurance policies with cash value provide a tax-efficient way of investing while offering life cover.

Moreover, annuities – long-term contracts purchased from an insurance company designed to help accumulate assets to provide income for retirement- can provide fixed or variable income based on the investments chosen. These forms of insurance-based investments can add another layer of diversification and aid in creating a robust portfolio resistant to market volatility.

Detailed Discussion on Risk Management Strategies

Harmonizing Chaos: The Power of Diversification

The strategy of diversification is akin to the adage “do not put all your eggs in one basket”. In investment parlance, this means spreading one’s investments across a variety of assets or asset classes so as to reduce exposure to any single asset or risk. By investing in a mix of assets that are unlikely to move in the same direction simultaneously, investors can potentially insulate themselves against significant losses.

This doesn’t guarantee profits or protect entirely against loss, but it can help investors manage the level and types of risk they take on. Furthermore, diversification has been time-tested as an effective method for mitigating risk and maximizing return potential.

It allows for the possibility that some investments may perform poorly at times, but others may do well and thus offset these losses. A properly diversified portfolio will include different types of securities from various industries with varying degrees of risk so as to create a balanced blend.

The Artful Balance: Mastering Asset Allocation

Asset allocation is another instrumental facet of investment strategy. It involves distributing your investments among different kinds of investment categories, such as bonds, stocks, real estate, and cash equivalents based on an investor’s financial objectives, risk tolerance and investment horizon. Just as a well-balanced diet contains a variety of different foods for comprehensive nutrition intake, an investor’s portfolio should comprise a blend of asset classes for optimal financial health.

Moreover, each class carries its own set of risks and rewards; hence determining what proportion should be allocated to each depends on individual circumstances and goals. For instance, stocks generally offer higher returns with higher risks while bonds provide moderate returns with lower risks.

Cash equivalents are low-risk but also offer minimal returns. A judicious mix based on individual needs forms the cornerstone for prudent asset allocation.

Conclusion

In the existential theatre of investment, understanding risks and managing them effectively is the key to success. By spreading investments across multiple assets and optimally allocating them as per individual needs and goals, one can create a robust defense mechanism against the whims of the unpredictable market. As we navigate through this complex labyrinthine world of investing, let these strategies be your guiding light, illuminating your path towards financial security and prosperity.

Remember: prudence pays off in patience and protection against potentially perilous pitfalls. Here’s to your well-diversified, thoughtfully allocated financial future!