Easy Project Funding

As we embark upon a journey through the world of economics, business and innovation, it is essential to understand one of the most crucial aspects that determine the success or failure of an enterprise: Project Funding. In this article, we will dissect what project funding means, its role in today’s fast-paced world and demystify the concept of easy project funding.

Making sense of Project Funding can be somewhat like trying to decipher an ancient script. However, once you get past the jargon and technicalities, it becomes more palatable and even fascinating for those with a taste for adventure in entrepreneurial waters.

A Comprehensive Definition of Project Funding

Project Funding refers to the process through which initial capital or funds are raised to kick-start an enterprise or a project. It encompasses every financial strategy employed by businesses to garner resources necessary for its inception, operation and growth.

It isn’t merely about accumulating monetary resources; it also involves strategic planning, resource allocation and risk assessment. Thus, Project Funding can be likened to a bridge linking dreams with reality – transforming abstract ideas into concrete projects.

The Indispensable Role of Project Funding in Today’s World

In today’s global landscape marked by innovation and entrepreneurship spirit, project funding emerges as a cornerstone building profitable enterprises from ground zero. It doesn’t just facilitate financial stability; it shapes ideas into potentially successful ventures capable of contributing significantly to economic progress.

Having sufficient funds provides entrepreneurs with creative freedom without the confinement imposed by budget constraints. It fosters innovation as businesses have access to resources necessary for research development and technological advancements—ultimately stimulating economic growth.

An Introduction to Easy Project Funding

In light of these truths about traditional project funding arises another intriguing arena: Easy Project Funding. This term may sound like an oxymoron given how complex procuring funds can typically be—the trials that entrepreneurs often face in securing enough capital to get their ventures off the ground, are testament to this. Easy Project Funding represents a range of techniques designed to make the funding process as straightforward as possible.

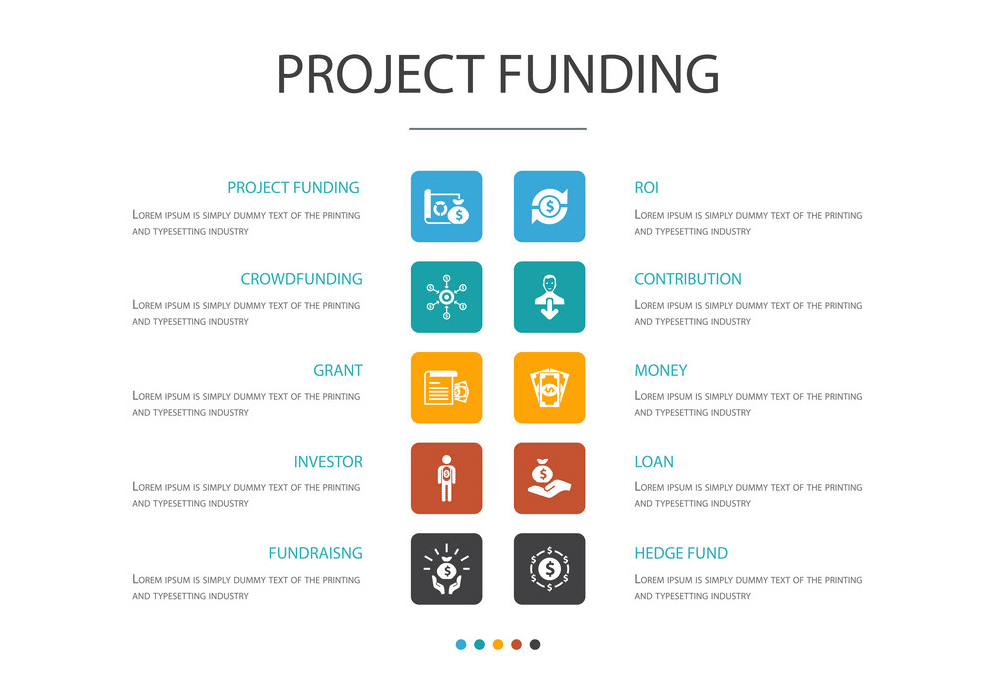

It is a more accessible, less complicated approach to gather monetary support for projects, harnessing modern resources and platforms available due to technological advancements. Through crowdfunding, grants and subsidies, angel investors and venture capitalists, small business loans and microloans – easy project funding has democratized entrepreneurship by making project funding more attainable for anyone with a viable idea.

Understanding the Concept of Easy Project Funding

Demystifying the Notion of Easy Project Funding

Easy Project Funding, a term that may seem paradoxical to some, essentially refers to simplified methods and strategies designed to accumulate financial resources for a project. Unlike traditional funding avenues which can be convoluted and time-consuming, these approaches prioritize accessibility and efficiency.

Easy Project Funding is often characterized by its reliance on digital platforms and modern financial practices that cater to the evolving needs of entrepreneurs. The concept is grounded in the notion that acquiring funds for a project should not be an insurmountable obstacle.

Rather, every visionary with a viable idea deserves a fair chance at making it come to fruition. It is this fundamental ethos that differentiates easy project funding from more conventional means.

A Deep Dive into the Principles of Easy Project Funding

A cardinal principle underpinning easy project funding is inclusivity – it opens doors for individuals who might find traditional routes inaccessible due to stringent eligibility criteria or bureaucratic red tape. It underscores the democratization of fundraising wherein your economic background or professional pedigree doesn’t dictate your potential for success.

Another core precept involves simplification; easy project funding streamlines complex procedures involved in securing finances by leveraging technology and innovative strategies, such as crowdfunding or peer-to-peer lending. This allows prospectors to focus more on their projects rather than getting tangled in arduous fundraising processes.

Pivotal Elements Involved in Easy Project Funding

Anatomy of Simplified Fundraising: Key Components

The process of easy project funding comprises several elemental components. The first among these is a robust platform through which funds can be raised – this could range from crowdfunding websites like Kickstarter or GoFundMe, angel investor networks, or online loan applications.

Another vital component is compelling storytelling; being able to articulate the vision and potential impact of a project is pivotal. It not only resonates with potential funders emotionally but gives them confidence in the endeavor’s success.

Interplay of Technology, Strategy, and Human Aspiration

Easy project funding represents an amalgamation of technology, strategic planning, and human ambition. In today’s interconnected world, social media plays a crucial role in amplifying the reach of fundraising campaigns, ensuring that they resonate with a wider audience. Moreover, strategic planning is vital in determining the most viable funding route based on the scale and nature of the project.

At its core lies human aspiration – individuals driven by their vision to innovate or create something valuable. Together these elements interact to make easy project funding not just a concept but a promising reality for numerous dreamers worldwide.

Different Types of Easy Project Funding

Crowdfunding

Crowdfunding, a relatively modern method of sourcing funds, involves gathering small amounts of money from a large number of individuals, typically via online platforms. These platforms serve as incubators, showcasing entrepreneurial projects to potent contributors around the globe.

Crowdfunding is further divided into several subtypes including equity crowdfunding, reward-based crowdfunding and donation-based crowdfunding to name a few. However, this seemingly uncomplicated process does have its downsides.

Often it can become challenging to reach the financial goal in a stipulated time period due to an inadequate number of backers or insufficient funds raised. Moreover, some platforms operate on an all-or-nothing basis meaning if the project fails to achieve its target sum within the designated timeframe, all donations are returned and the project gets no funding at all.

Grants and Subsidies

Grants and subsidies are essentially free money provided by governments or private foundations for specific types of businesses or projects. They provide a significant boost especially for startups and non-profit organizations.

Applying for them usually involves developing comprehensive proposals that demonstrate how your project aligns with the grant’s goals. Nonetheless, securing government grants and subsidies can be highly competitive given their non-repayable nature.

It also requires substantial time investment due to often lengthy application processes. Moreover, they are usually contingent upon strict business performance requirements which can create added pressure on your organization.

Detailed Analysis on Each Type of Easy Project Funding

Crowdfunding: Pros, Cons, Best Platforms & Successful Examples

Crowdfunding offers numerous advantages such as raising risk-free capital from diverse sources along with testing market receptiveness towards your product before full-scale production commences. Popular platforms include Kickstarter and Indiegogo which have successfully funded thousands of projects worldwide such as Pebble smartwatch and Flow Hive honey extractor.

Yet, crowdfunding does have its cons like potential intellectual property theft risks and immense pressure to deliver promised products on time. Also, while some projects like Exploding Kittens card game raised millions in mere days, many others fail to reach their goal due to lack of publicity or convincing presentation which highlights the unpredictable nature of this funding method.

Grants and Subsidies: How to Apply, Success Rates & Case Studies

The first step towards applying for grants and subsidies involves research. Identify the right grant for your project by consulting databases such as grants.gov or Foundation Directory Online. These resources provide details about eligibility criteria and application deadlines among other useful information.

However, bear in mind that per National Center for Charitable Statistics, only about 10% of applicants receive federal grants indicating fierce competition. Case studies like Tesla receiving $465 million loan from Department of Energy under Advanced Technology Vehicles Manufacturing Loan Program underscore how these funds can accelerate a business towards success despite the tough odds.

Niche Aspects of Easy Project Funding

Role of Social Media in Crowdfunding Campaigns

In today’s digital age, social media plays a pivotal role in crowdfunding campaigns providing them with visibility and momentum. Platforms like Facebook and Twitter not only amplify your project’s reach but also facilitate engagement with potential backers through interactive content sharing. However, successful social media campaigning requires strategic planning including identifying target audience demographics and preferred communication channel along with regular updates showcasing progress achieved through backers’ contributions ensuring their continued support and attraction of new sponsors.

Government Policies Impacting Grants & Subsidies

Government policies greatly impact availability and accessibility of grants & subsidies. Policies encouraging entrepreneurship or emphasizing certain sectors invariably lead to increased grant opportunities therein. Moreover regulatory ease pertaining to grant applications can significantly expedite disbursal process making these funds more accessible.

Nonetheless, changes in political climate can affect these policies leading to unpredictability. Therefore, regular monitoring of policy shifts is essential for organizations dependent on these non-repayable funds for their operational or expansion activities.

The Process Involved in Securing Easy Project Funds

Preparation Phase – Creating a Solid Business Plan or Proposal

The first step towards securing project funding involves creating a comprehensive and persuasive business proposal. This document details your project’s objectives, required resources, projected timeline and potential risks among other aspects. A well-structured proposal not only convinces prospective funders of your project’s viability but also provides you with a roadmap guiding your venture towards success.

However remember that developing such a plan demands significant time and effort investment. Further, it might require multiple iterations based on funders’ feedback before acceptance is achieved making patience an indispensable virtue in this endeavor.

Application Phase – Submitting the Proposal or Plan

Once the proposal is perfected, comes the application phase where it’s submitted to potential financiers be they crowdfunding platforms, government bodies issuing grants or private investors. The application process varies depending on the funding source requiring diligent research to ensure compliance with specific prerequisites. Yet, keep in mind that despite meticulous preparation and submission of applications there are no guarantees of securing funds owing to various uncontrollable factors such as competitive landscape or funders’ changing priorities emphasizing need for perseverance during this phase.

The Role Of Technology In Streamlining The Process Of Getting Funds Easily

FinTech Solutions for Easier Fund Management

Financial technology (FinTech) has revolutionized traditional banking and financial services offering innovative solutions that not only simplify but also expedite the process of securing funds. Platforms like Kickstarter and GoFundMe have made crowdfunding accessible while online lenders like Kabbage offer small business loans without tedious paperwork associated with traditional banks. However, while FinTech undoubtedly provides seamless user experience and convenience, it’s important to ensure that the selected platform is reliable and secure given the sensitive nature of financial transactions involved.

Conclusion

Securing project funding can be a daunting task but with the right strategies and tools, this process can be made less cumbersome. As we traverse further into the digital age, technology will continue to play a vital role in simplifying funding processes providing entrepreneurs with more opportunities to bring their innovative ideas to fruition.

Remember that with every rejection comes an opportunity for learning and improvement. Stay positive, persistent and open-minded throughout your funding journey!