Leveraged-Finance

Definition and Overview

Leveraged finance, within the realm of corporate finance, represents a captivating subset that holds immense significance for businesses seeking capital. It primarily revolves around the concept of leverage, which refers to the strategic use of borrowed funds to amplify potential returns.

Leveraged finance involves sophisticated financial transactions where companies employ debt instruments to fund their operations, expansion endeavors, or acquisitions. Unlike traditional financing methods that rely heavily on equity financing through issuing shares, leveraged finance offers an alternative approach that enables corporations to harness external sources of capital while maintaining control over ownership.

Explanation of Leveraged Finance as a Subset of Corporate Finance

In essence, leveraged finance tackles the intricate dynamics involved in optimizing a firm’s capital structure by utilizing various types of debt instruments alongside equity. This subset delves into understanding how companies can strike a balance between risk and reward when deploying borrowed funds strategically within their financial frameworks. By incorporating leverage into their corporate finance strategies, organizations can exploit market inefficiencies and achieve higher returns on investment than what would be possible solely with equity financing.

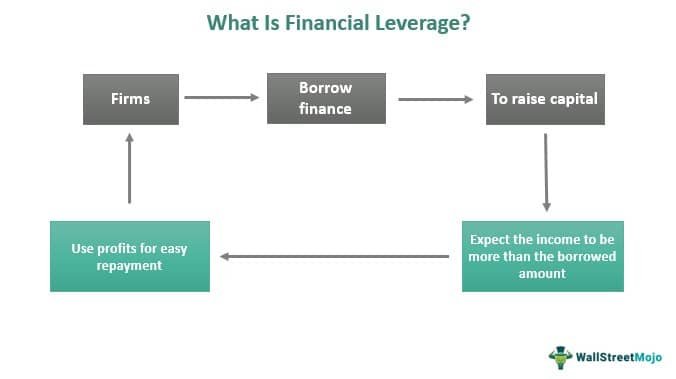

Definition of Leverage and Its Role in Financing Strategies

Leverage embodies the concept of using borrowed money or other forms of indebtedness to amplify investment returns or increase economic potential. It functions as an essential tool within financing strategies by allowing businesses to maximize the impact of their invested capital without solely relying on internal funds or diluting ownership stakes through issuing additional shares. By employing leverage judiciously, companies can enhance profitability and accelerate growth initiatives while effectively managing potential risks.

Importance of Leveraged Finance

How leveraged finance enables companies to pursue growth opportunities In today’s fiercely competitive business landscape, pursuing growth opportunities is integral for long-term survival and success. Leveraged finance plays a pivotal role in this pursuit by providing companies with access to additional capital beyond their internal resources.

By leveraging their assets and utilizing different forms of debt, such as loans or bonds, businesses can fund expansion initiatives, develop new products or services, penetrate new markets, or invest in research and development. This strategic use of external financing allows companies to seize growth opportunities that would have been otherwise unattainable given the limitations of internally generated funds.

Role of Leverage in Mergers and Acquisitions

Mergers and acquisitions (M&A) are complex transactions that require substantial financial resources. Leverage plays a crucial role in facilitating these deals by allowing acquirers to finance a significant portion of the purchase price through borrowed funds. By employing leverage as part of their M&A strategies, companies can conserve their cash reserves for operational needs while still pursuing strategic combinations.

Additionally, leverage provides flexibility and enhances the return on investment potential for acquirers when executed judiciously. It enables firms to unlock synergies, expand market share, consolidate operations, and ultimately create value for shareholders through well-executed mergers and acquisitions.

Types of Leveraged Finance Instruments

Senior Debt

Senior debt represents the most secure form of leverage within the realm of leveraged finance. It refers to loans or credit facilities that hold a higher priority in terms of repayment in the event of a company’s liquidation or bankruptcy.

Such debt is backed by specific assets or collateral, which act as security for lenders. Senior secured loans, in particular, have gained popularity due to their lower risk profile.

These loans are typically secured by tangible assets like real estate, equipment, or inventory and offer higher recovery rates for lenders compared to other forms of debt. Furthermore, senior secured loans often come with favorable terms such as lower interest rates and longer repayment periods due to the reduced risk borne by creditors.

Mezzanine Debt

Mezzanine debt occupies an intermediate position between traditional debt and equity financing options. This hybrid instrument combines attributes of both types, thus allowing companies to raise capital while managing risk and optimizing their capital structure. Mezzanine debt is characterized by its subordinated status, meaning it ranks below senior debt in terms of repayment priority but above equity shareholders.

Consequently, mezzanine lenders demand higher interest rates than senior lenders due to assuming a greater level of risk. Additionally, mezzanine financing often includes features such as warrants or options that provide potential upside participation for investors if the company performs well over time.

High-Yield Bonds (Junk Bonds)

High-yield bonds, commonly referred to as junk bonds due to their perceived higher credit risk compared to investment-grade bonds, are another significant component of leveraged finance instruments. These bonds offer yields that exceed those provided by government or investment-grade corporate bonds because they expose investors to greater levels of credit risk associated with companies having less-than-optimal credit ratings and financial stability. In return for accepting this heightened risk, investors demand higher interest rates to compensate for potential losses.

High-yield bonds often attract companies with lower credit ratings seeking capital to finance growth initiatives or restructure existing debt. Despite their inherent risk, high-yield bonds serve as a crucial avenue for companies to access capital markets when traditional bank financing may be limited or expensive.

Players in the Leveraged Finance Market

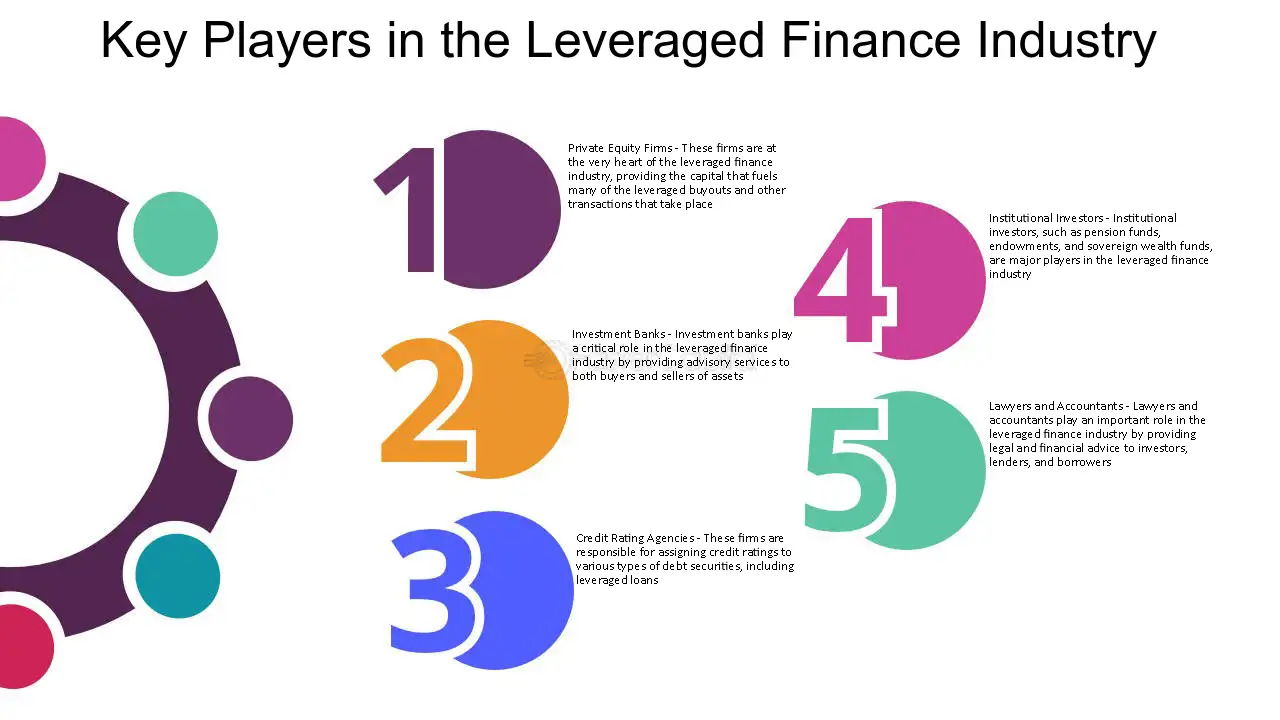

Investment Banks

In the intricate world of leveraged finance, investment banks play a crucial role in structuring deals and providing financial expertise. These institutions act as intermediaries between companies seeking financing and investors looking for opportunities to deploy capital. Investment banks have a deep understanding of the complex financial structures involved in leveraged finance, allowing them to tailor solutions that meet the specific needs of their clients.

They assist in determining optimal debt levels, negotiating terms with lenders, and advising on deal pricing. Additionally, investment banks facilitate syndication by leveraging their extensive network of relationships with other financial institutions and investors, enabling them to distribute loan obligations among multiple parties.

Private Equity Firms

Private equity firms are active participants in the realm of leveraged finance, utilizing this financing strategy to fund acquisitions and enhance returns for their investors. Leveraging enables private equity firms to amplify their purchasing power by using borrowed funds alongside their own capital.

By deploying leverage strategically, these firms can acquire larger companies or portfolios that would otherwise be unattainable solely with equity financing. This approach allows private equity firms to maximize shareholder value through increased operational efficiency and growth opportunities while carefully managing risk levels associated with leverage.

Credit Rating Agencies

Credit rating agencies play a vital role in assessing risk associated with leveraged finance instruments such as bonds or loans. These independent organizations evaluate the creditworthiness of borrowers by assigning ratings based on factors like financial performance, debt ratios, industry dynamics, and market conditions.

The importance of credit rating agencies lies in providing an objective assessment that helps investors gauge the level of risk they are taking when investing in leveraged finance instruments. Based on these ratings, pricing for such instruments is determined; higher-rated issuers enjoy lower borrowing costs due to their perceived lower risk profile.

Conclusion

As we explore the realm of leveraged finance and its key players, it becomes evident that investment banks, private equity firms, and credit rating agencies are integral to the functioning of this market. Investment banks not only structure deals but also facilitate syndication, creating opportunities for various parties to participate in leveraged finance transactions. Private equity firms utilize leverage to enhance returns for their investors while strategically acquiring companies or portfolios.

Credit rating agencies provide essential risk assessment, aiding investors in making informed decisions about investing in leveraged finance instruments. Together, these players contribute to the growth and dynamism of the leveraged finance market, fostering economic development and innovation.