Greet the Dawn of Investment Finance

Welcome, dear reader, to the exhilarating world of investment finance. Herein awaits a voyage of discovery that navigates through the labyrinthine intricacies of money management and wealth growth.

The quintessence of financial well-being lies not in how much you earn, but rather in how you manage your funds; it hinges on your prowess in investment finance. As we embark on this journey together, we will unravel the enigma that is investment finance – demystifying its complexities and laying bare its sheer potential for personal prosperity and business growth.

Definition of Investment Finance

The Bedrock of Wealth Building: Investment Finance

Investment finance can best be described as an integral branch of economics concerned with resource allocation over time under uncertainty. It encapsulates the process through which savings or capital is allocated to different avenues with an expectation of favourable returns that combat inflation and help increase wealth.

In more colloquial terms, investment finance is akin to a seed sown today with hopes that it sprouts into a fruitful tree tomorrow. By investing money today, one hopes for greater financial returns in future – it’s essentially about growing your wealth over time.

Importance of Investment Finance in Personal and Business Perspectives

A Personal Passage to Prosperity: Why Investment Finance Matters?

On a personal front, mastering investment finance is tantamount to securing one’s financial future. Consider it as an umbrella protecting you from torrential life uncertainties like medical emergencies or sudden loss of income. The significance extends beyond mere protection; it plays a pivotal role in accomplishing life goals such as buying a house or planning for retirement.

While saving provides only limited growth due to inflation eroding purchasing power over time, investing empowers individuals by potentially providing higher returns, thereby accelerating wealth accumulation. It’s the fuel powering the vehicle to your financial goals.

Fiscal Fruits for Firms: Investment Finance in Business

From a business perspective, investment finance is equally vital, if not more so. Businesses aren’t mere economic entities; they’re growth-seeking ventures that must judiciously allocate capital to yield optimal returns and ensure survival amidst cutthroat competition.

Investment finance plays an instrumental role in guiding this capital allocation, be it investing in research and development for a new product line or assessing the viability of expanding operations globally. It’s through savvy investment decisions that businesses can achieve sustainable growth and enhance shareholder value over time.

Understanding the Basics of Investment Finance

Unveiling the Concept of Risk and Return

The pivotal backbone of investment finance entails grasping the concept of risk and return. In its raw essence, it refers to potential financial loss or profit an investor may encounter in their investment journey. The intricate entwining between risk and return reflects a fundamental principle: higher potential returns are generally associated with higher risks.

In other words, if an investor seeks lucrative profits, they must be willing to shoulder increased levels of risk. Conversely, conservative investments offer lower returns but carry less risk.

Investment risks can stem from a myriad of sources, including market volatility, inflation fluctuations, economic downturns or even geopolitical instability. However, astute investors often employ various strategies such as diversification or hedging to mitigate these risks while aiming for optimal returns on their investments.

A Panorama View: Different Types of Investments

In the financial realm, several different types of assets can be invested in; each offers distinctive characteristics and benefits that cater to the diverse needs and preferences of investors.

Stocks: A Slice Of Ownership

When you purchase stocks or shares in a corporation, you essentially become a partial owner – no matter how minuscule your share is – in that business entity. Stocks are inherently volatile due to their direct correlation with business performance and overall market conditions; hence they offer high return potentials along with equally high risk. An astute investor keeps track not only on individual company performance but also take into account larger economic trends as well as industry-specific developments which may influence share prices.

Bonds: Lending for Interest

While stocks represent ownership, bonds correspond to loans taken by entities (governments or corporations). When you purchase a bond, you are essentially lending money to the issuer for a specified period in return for periodic interest payments.

Bonds are considered less risky than stocks and, consequently, they offer lower returns. They provide a predictable income stream and hence form an integral part of conservative investors’ portfolios.

However, bonds aren’t completely devoid of risks. Credit risk (bond issuer defaulting on interest or principal repayments) and interest rate risk (rising interest rates can cause the price of existing bonds to fall) are some significant risks associated with bond investments.

Mutual Funds: Pooling for Diversification

Mutual funds allow investors to pool their money together to invest in a diverse array of assets such as stocks, bonds, money market instruments etc. it’s an effective way to achieve diversification even with limited capital at disposal. In addition to diversification benefits mutual funds offer professional management – where seasoned fund managers make investment decisions on behalf of investors.

Real Estate: Tangible Assets

Investing in real estate involves purchasing physical property like residential homes, commercial properties or vacant land. As physical assets, these properties often appreciate over time and can provide steady income through rentals.

However investing in real estate requires significant upfront capital and is not as liquid as other financial securities (it takes time to sell property). Also factors like location, property condition & market conditions greatly influence the profitability from real estate investments.

Commodities: The Raw Materials Market

Commodities refer to raw materials used across various industries – metals like gold & silver; energy resources like oil & gas; agricultural products etc. Commodities act as a hedge against inflation because their prices typically rise when inflation accelerates. However, commodities are susceptible to sudden price swings due to factors such as supply-demand imbalances, exchange rate movements and geopolitical events. Hence investing in commodities should be approached with an informed and measured strategy.

Time is Money: The Time Value of Money

The time value of money (TVM) is an indispensable concept in finance that maintains that a dollar today is worth more than a dollar in the future. This principle underpins the rationale that money available now can be invested to earn returns over time, thus increasing its value. Two key components of TVM are present value (PV) and future value (FV).

The former assesses what the future cash flow is worth today, while the latter projects the growth of an investment made now into the future. Understanding TVM aids in crucial investment decisions like comparing investment options or evaluating loan costs.

Deep Dive into the World of Stocks: A Crucial Part of the Financial Ecosystem

Stocks, often referred to as equities, represent ownership in a corporation and constitute a claim on part of a corporation’s assets and earnings. The beauty of stocks lies in their dual benefit structure – they not only give the investor an opportunity to share in company’s profits via dividends but also offer potential for substantial capital appreciation if the market price increases over time.

The stock market essentially facilitates the buying and selling of these shares between buyers and sellers. A stock quote is akin to a report card for a company.

It provides essential information including its current price, volume traded, historical highs and lows, earnings per share (EPS), dividend yield, price-to-earnings (P.E) ratio among others. A prudent investor carefully takes into account all these variables before making any investment decision.

Diverse Strategies for Stock Investing: A Pathway to Financial Success

Investment strategies typically vary based on an individual’s risk tolerance, investment goals and time horizon. Growth investing focuses on investing in companies that are expected to grow at an above-average rate compared to other companies in the market. Value investing involves finding undervalued stocks – those that are trading for less than their intrinsic values.

Income investing prioritizes stocks that regularly pay dividends while dollar-cost averaging involves regularly investing fixed amounts irrespective of market conditions thereby reducing impact of volatility. The key lies not only in understanding these strategies but also applying them effectively by monitoring market dynamics & adapting your strategy when necessary.

Bond Investments: Harnessing Institutional Debt Markets

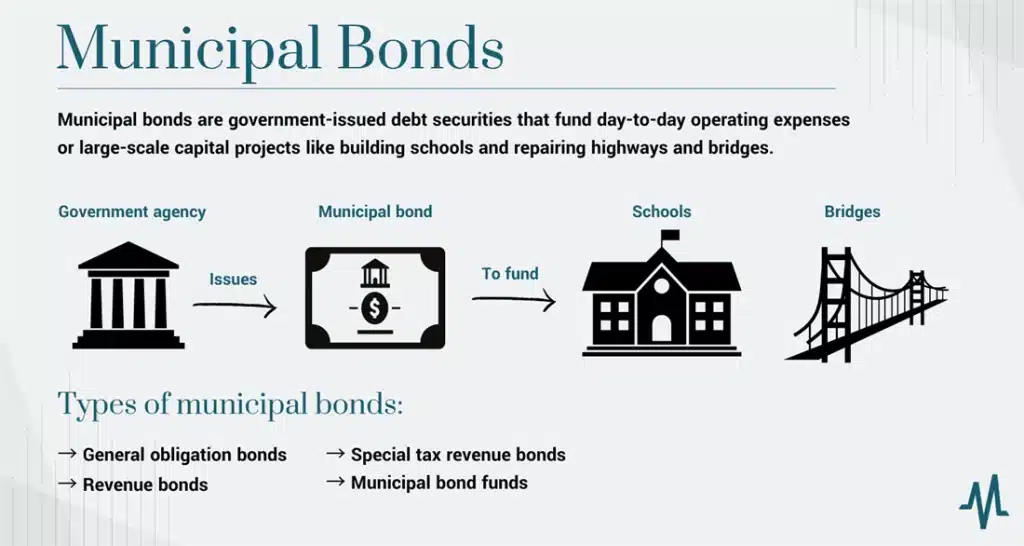

Bonds are fundamentally loans given by investors to entities such as governments or corporations who then return this loan with interest over time. Key parameters include coupon rate (annual interest payment), face value (loan amount to be repaid at maturity) and yield to maturity which is the total return if the bond is held until it matures. There are various types of bonds.

Government bonds are viewed as extremely secure, backed by the credibility of a nation, while corporate and municipal bonds come with varying degrees of risk. It must be noted that all bonds carry some level of risk, including interest rate risk, inflation risk and credit risk.

Mutual Funds and ETFs: A Gateway to Diversified Investments

Mutual funds pool money from various investors to create a large asset corpus managed by financial experts. These funds can invest in a variety of assets – stocks, bonds etc. Exchange-Traded Funds or ETFs similarly offer diversified exposure but are traded like individual stocks on an exchange.

These instruments not only offer diversification but also ease of management as professionals handle investment decisions. However, they also carry risks related to market volatility and fund management performance hence selecting the right mutual fund or ETF becomes vitally important for any investor.

Real Estate: Investing in Brick & Mortar

The allure of real estate investments often lies in its tangible nature – you can touch & feel your investment. One can invest in residential properties for rental income or capital appreciation or commercial properties that typically yield higher returns than residential counterparts but come with increased risks.

The pros include potential for stable rental income, tax benefits & capital appreciation while cons involve illiquidity, maintenance costs & market fluctuations. As always thorough research is key before plunging into this sector.

Commodities: Tangible Assets in Your Portfolio

Commodities like gold, silver oil etc., serve a distinct purpose in an investment portfolio providing a hedge against inflation and serving as a safe haven during turbulent times. These assets are often inversely correlated with stocks and bonds thereby providing much needed balance in an investor’s portfolio.

However, commodities can be quite volatile impacted by global economic and political events. Thus, while they can enhance portfolio returns, they also add significant risk.

Understanding Market Trends & Economic Indicators: Gauging the Investment Climate

Investment is not just about picking the right asset but also about timing your entry and exit. Understanding market trends – bullish (rising prices) or bearish (falling prices) – and economic indicators such as GDP growth rates, unemployment levels etc., can provide valuable insights into where the market might be headed. An investor who accurately reads these signals stands to gain significantly more than one who invests blindly.

Conclusion

Investment finance offers a range of possibilities for increasing wealth and achieving financial goals. However, it requires a nuanced understanding of various investment options & strategies along with keen awareness of market trends & economic indicators.

Investing wisely involves not just knowledge but discipline, patience & a willingness to take calculated risks. Here’s to you venturing on this exciting journey filled with potential rewards and countless opportunities for personal growth!