Project Finance

Definition and Overview

Project Finance is a specialized financing technique employed for large-scale infrastructure and industrial projects. Unlike traditional corporate finance, which relies on the creditworthiness of the sponsoring company, project finance structures individual projects as independent entities.

This means that the lender’s primary source of repayment is the cash flow generated by the project itself, rather than the general assets or creditworthiness of the sponsor. By isolating each project, risks can be better assessed and allocated between different stakeholders in a comprehensive manner.

Importance and Application in Various Industries

The importance of project finance cannot be overstated, as it plays a pivotal role in driving economic development across various industries. From energy plants to transportation infrastructure, telecommunications networks to mining operations, project finance acts as a catalyst for capital-intensive projects that might otherwise remain unattainable.

This financing technique offers an attractive solution for ventures with long-term payback periods that may deter conventional lenders due to their high initial costs and associated risks. Project finance finds extensive application across multiple sectors worldwide.

In renewable energy, it enables the construction of large-scale wind farms or solar power plants by pooling resources from multiple investors and lenders who share both risks and rewards. It also facilitates major transportation projects such as highways, bridges, ports, and airports through partnerships between government agencies, private developers, and financial institutions.

The oil and gas industry extensively utilizes project finance for exploration activities or construction of refineries while spreading risk among equity participants. Moreover, public-private partnership (PPP) initiatives in healthcare facilities or education institutions often rely on project finance structures to provide essential infrastructure while leveraging private sector expertise.

The versatility of this financing method makes it adaptable to diverse sectors where capital-intensive projects are prevalent. Project finance enables complex endeavors by securing funding through innovative structures tailored specifically to individual projects’ unique characteristics.

Its application spans across industries, serving as a critical enabler for economic growth and infrastructure development. By shifting the focus from corporate balance sheets to project-specific cash flows, project finance can unlock opportunities and expedite progress in sectors that are crucial for societal advancement.

Key Players in Project Finance

Sponsors/Developers

The sponsors or developers are the driving force behind project finance initiatives. They play a crucial role in conceptualizing, planning, and executing the project from start to finish.

These individuals or entities take on the responsibility to ensure that the project is viable and profitable. Their main responsibilities include conducting feasibility studies, securing permits and licenses, raising capital, managing risks, and overseeing project implementation.

Sponsors may consist of private companies, government agencies, or a consortium of both. They bring together a diverse range of expertise and resources required to transform an idea into a tangible project.

Types of sponsors

Sponsors in project finance can be broadly categorized into two types: equity sponsors and limited-recourse financiers. Equity sponsors provide the initial capital investment required for the development of the project.

They have a significant stake in the venture’s success as they contribute their own funds and often seek additional financing from external investors such as private equity firms. On the other hand, limited-recourse financiers are typically financial institutions that provide loans secured by specific assets or cash flows generated by the project itself.

Lenders/Financiers

In order to fund large-scale projects with substantial capital requirements, lenders and financiers play a vital role in facilitating funding arrangements for sponsors. Banks and financial institutions are prominent players in providing debt financing for projects. These lenders carefully assess various factors such as creditworthiness, track record, projected cash flows, collateral security options before extending credit facilities to sponsor entities.

Export credit agencies (ECAs) also form an important part of project finance transactions where there is an international dimension involved. ECAs typically facilitate lending by offering guarantees or insurance cover for loans provided by commercial banks or other financial institutions involved in cross-border transactions.

Multilateral development banks (MDBs) such as the World Bank, Asian Development Bank, and European Investment Bank are crucial players in project finance by providing long-term loans or grants to developing nations and emerging economies. MDBs help mitigate risks associated with projects in these regions, thereby encouraging private sector participation and sustainable development.

Contractors/Suppliers

Project development involves the active involvement of contractors and suppliers who provide specialized services and equipment necessary for implementation. Construction companies play a significant role in executing the physical aspects of the project, including site preparation, engineering design, procurement of materials, construction management, and ensuring compliance with safety standards. These companies often form strategic partnerships with sponsors to ensure efficient project delivery within agreed-upon timelines.

In addition to construction firms, equipment suppliers form another important category of contractors involved in project finance initiatives. These suppliers provide crucial machinery, tools, and technology required for effective implementation.

They may contractually bind themselves to deliver equipment on time or provide maintenance services during the operational phase of the project. By bringing together sponsors/developers, lenders/financiers, contractors/suppliers collectively contribute their unique expertise towards successful project execution while sharing risks associated with various stages of project development.

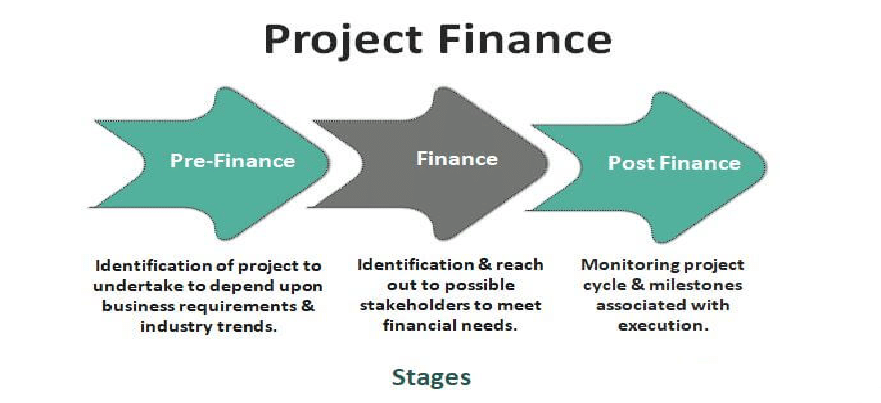

Project Development Process

Pre-feasibility stage

The pre-feasibility stage marks the initial phase of project development in project finance. During this crucial stage, the project idea is conceptualized and subject to an initial assessment.

This assessment entails evaluating the viability and potential success of the proposed project. Key considerations include market demand, financial feasibility, technical feasibility, and legal aspects.

The process involves conducting thorough research on market trends and dynamics, analyzing potential risks and rewards, and assessing regulatory requirements. Moreover, this stage also involves preliminary discussions with stakeholders to gather their input and support for the proposed project.

Conceptualization and initial assessment

In the conceptualization phase of pre-feasibility, project developers brainstorm innovative ideas to address an identified need or capitalize on a business opportunity. During this phase, various concepts are explored in terms of their potential impact on target markets or industries.

Once a viable concept is identified, an initial assessment is conducted to determine its feasibility. This involves evaluating factors such as market size and growth potential, competitive landscape analysis, estimated costs versus expected revenues, as well as any legal or regulatory constraints that may affect implementation.

Technical studies and market analysis

As part of the pre-feasibility stage in project development process lies technical studies and comprehensive market analysis. Technical studies focus on evaluating aspects such as site suitability assessments (availability of land or resources), infrastructure requirements (accessibility to transportation networks), technological feasibility (availability of required technology), as well as construction timelines and costs estimation. Market analysis encompasses analyzing customer needs/preferences, competitive positioning strategies for similar projects/products/services already existing in the market space under consideration.

Feasibility stage

Once a concept has passed through pre-feasibility assessment successfully, it moves into the next phase known as the feasibility stage. This phase involves conducting detailed project design and engineering, along with an environmental impact assessment.

Detailed project design and engineering

During this stage, the project undergoes a thorough and detailed design process. This encompasses architectural plans, engineering drawings, and technical specifications necessary for the construction or implementation of the project.

The team responsible for this phase works to refine the initial concept by addressing any potential technical challenges or limitations. They identify appropriate materials, equipment, technologies, and methodologies required for successful execution.

Environmental impact assessment

The feasibility stage includes conducting an environmental impact assessment (EIA), which is a critical step in ensuring sustainable project development. An EIA evaluates the potential environmental consequences associated with the proposed project.

It examines factors such as air quality, water usage/contamination, land use changes, noise pollution, biodiversity preservation measures, and social impacts on local communities. The findings help guide decision-making processes to minimize negative effects on ecosystems and communities while maximizing positive outcomes.

Financial structuring stage

After passing through pre-feasibility and feasibility stages successfully comes the financial structuring stage of a project’s development process in project finance.

Developing the financial model

During this stage, a robust financial model is developed to assess the economic viability of the proposed project. The financial model considers various parameters such as investment costs (including land acquisition if applicable), operating expenses (including labor costs), sales projections (based on market analysis), projected revenues (taking into account pricing strategies), taxation implications, and potential financing structures available for funding. This comprehensive analysis helps determine whether or not a project can generate adequate returns to attract investors or secure necessary loans.

Risk assessment and allocation

Risk assessment plays a crucial role in mitigating potential pitfalls throughout a project’s lifecycle. In this phase, risks associated with various aspects of the project are identified, evaluated, and allocated to the parties best equipped to manage them. These risks may include construction delays, regulatory changes, currency fluctuations, commodity price variations, political instability, or environmental contingencies.

Effective risk allocation strategies enhance the project’s chances of success by ensuring clear responsibilities and appropriate mitigation measures are in place for each identified risk. This stage requires meticulous analysis and collaboration among project sponsors, lenders, contractors, and relevant stakeholders to strike a balance between risk and reward.

Types of Project Finance Structures

When it comes to financing large-scale projects, there are different structures that can be employed. Two prominent ones are project finance and corporate finance. While both serve the purpose of raising capital, they differ significantly in terms of risk allocation and repayment structure.

Project Finance vs Corporate Finance

In corporate finance, funds are typically raised based on the creditworthiness and assets of the entire company. This approach allows for flexibility in allocating funds across various projects, but also exposes the company’s overall financial health to potential risks.

On the other hand, project finance is specifically tailored for individual ventures or projects. It involves creating a separate legal entity to ring-fence the risks and liabilities associated with a particular project.

The key advantage of project finance lies in its ability to mitigate risks by separating them from sponsors’ or developers’ balance sheets. By isolating individual projects, lenders can evaluate their viability independently and assess specific risks associated with each venture.

Non-recourse Financing Structure

In project finance, non-recourse financing is commonly used. This structure puts a greater emphasis on the cash flow generated by the project itself rather than relying solely on sponsors’ or developers’ assets as collateral for loans. Non-recourse financing reduces sponsors’ personal liability in case of default, as lenders have limited claims only on the assets related to that specific project.

This type of financing is particularly attractive for projects with substantial capital requirements or high-risk profiles since it shields sponsors from potential losses that could impact their entire business portfolio. However, lenders extensively scrutinize these projects before extending funding due to higher perceived risks associated with limited recourse options.

Limited Recourse Financing Structure

Limited recourse financing strikes a balance between non-recourse structures and traditional corporate finance. In this structure, lenders have a more significant claim over the project’s assets and can access sponsors’ or developers’ other assets if the project fails to meet repayment obligations.

This arrangement offers sponsors more flexibility and allows them to allocate a portion of the risk associated with a project to their broader portfolio. Limited recourse structures are often used in projects that have moderate risks but still require some level of protection for lenders.

By implementing limited recourse financing, sponsors can demonstrate their commitment to the project while offering additional security to lenders, leading to favorable borrowing terms. This structure incentivizes sponsors to diligently manage projects and ensure a successful outcome while also mitigating potential losses for lenders.

Sources of Funding for Projects

Equity Financing

Under equity financing, projects secure funds through the issuance of shares or ownership stakes. This form of financing involves two primary sources: the sponsor’s equity contribution and private equity investors. The sponsor’s equity contribution refers to the sponsor’s own financial investment in the project.

It demonstrates their commitment and confidence in the project’s success. Sponsors typically contribute a significant portion of the overall project cost, which can range from 20% to 40%.

Private equity investors, on the other hand, provide capital in exchange for an ownership stake in the project. These investors are attracted to projects with strong growth potential and aim to generate substantial returns on their investments.

Debt Financing

Debt financing is another vital source of funding for projects. It involves borrowing money from various sources with a promise to repay it over time, typically with interest.

Commercial bank loans are a common form of debt financing for projects. Banks assess creditworthiness based on factors such as project feasibility, cash flow projections, collateral, and the borrower’s financial standing.

Bond issuances represent another avenue for debt financing where projects issue fixed-income securities known as bonds to raise capital from investors. These bonds come with specified interest rates and maturity dates, making them attractive options for institutional investors seeking stable returns.

Export credit agencies (ECAs) also play a significant role in funding projects by providing loans or guarantees to support exports related to infrastructure development or equipment procurement. Overall, these sources of funding – equity financing through sponsor contributions and private investors along with debt financing via commercial bank loans, bond issuances, and support from export credit agencies – provide crucial avenues for securing funds necessary for project development and implementation.

Risk Management in Project Finance

Technical Risks

In the realm of project finance, technical risks are inherent due to the complex nature of large-scale projects. Construction risks pose challenges that can arise from delays, cost overruns, and quality control issues. These risks can be mitigated by conducting thorough feasibility studies, ensuring effective project management, and employing experienced contractors.

Technology risks, on the other hand, revolve around the implementation and performance of cutting-edge technologies required for a project’s success. Extensive research, rigorous testing procedures, and contingency plans can minimize these risks.

Financial Risks

Project finance is exposed to various financial risks that must be carefully managed to ensure project viability. Interest rate risk refers to fluctuations in interest rates during the life cycle of a project.

This risk can impact financing costs and affect project profitability. Adopting appropriate interest rate hedging strategies such as derivative instruments or fixed-rate loan agreements can provide stability in uncertain market conditions.

Foreign exchange risk arises when revenue streams and debt obligations are denominated in different currencies. Effective currency hedging mechanisms like forward contracts or currency swaps can mitigate potential losses due to exchange rate fluctuations.

Conclusion

Managing risks is an integral part of successful project finance endeavors. Technical risks demand meticulous planning during both construction and technology implementation phases to minimize delays and ensure quality outcomes. Financial risks necessitate proactive measures such as employing suitable interest rate hedging instruments to safeguard against volatile market conditions and adopting foreign exchange risk management strategies to mitigate currency fluctuations’ adverse effects.

Navigating these challenges requires a comprehensive understanding of risk assessment and allocation throughout the project’s life cycle. By implementing robust risk management practices alongside careful monitoring and adaptation strategies, stakeholders involved in project finance ventures can enhance their chances of achieving desired outcomes while safeguarding their investments.

Ultimately, embracing a proactive approach towards managing both technical and financial risks in project finance can pave the way for successful project execution and deliver positive returns on investment. With proper risk mitigation strategies in place, stakeholders can confidently embark on ambitious projects, knowing they have taken prudent steps to safeguard against potential obstacles.