Trade Financing

Definition and Significance of Trade Financing

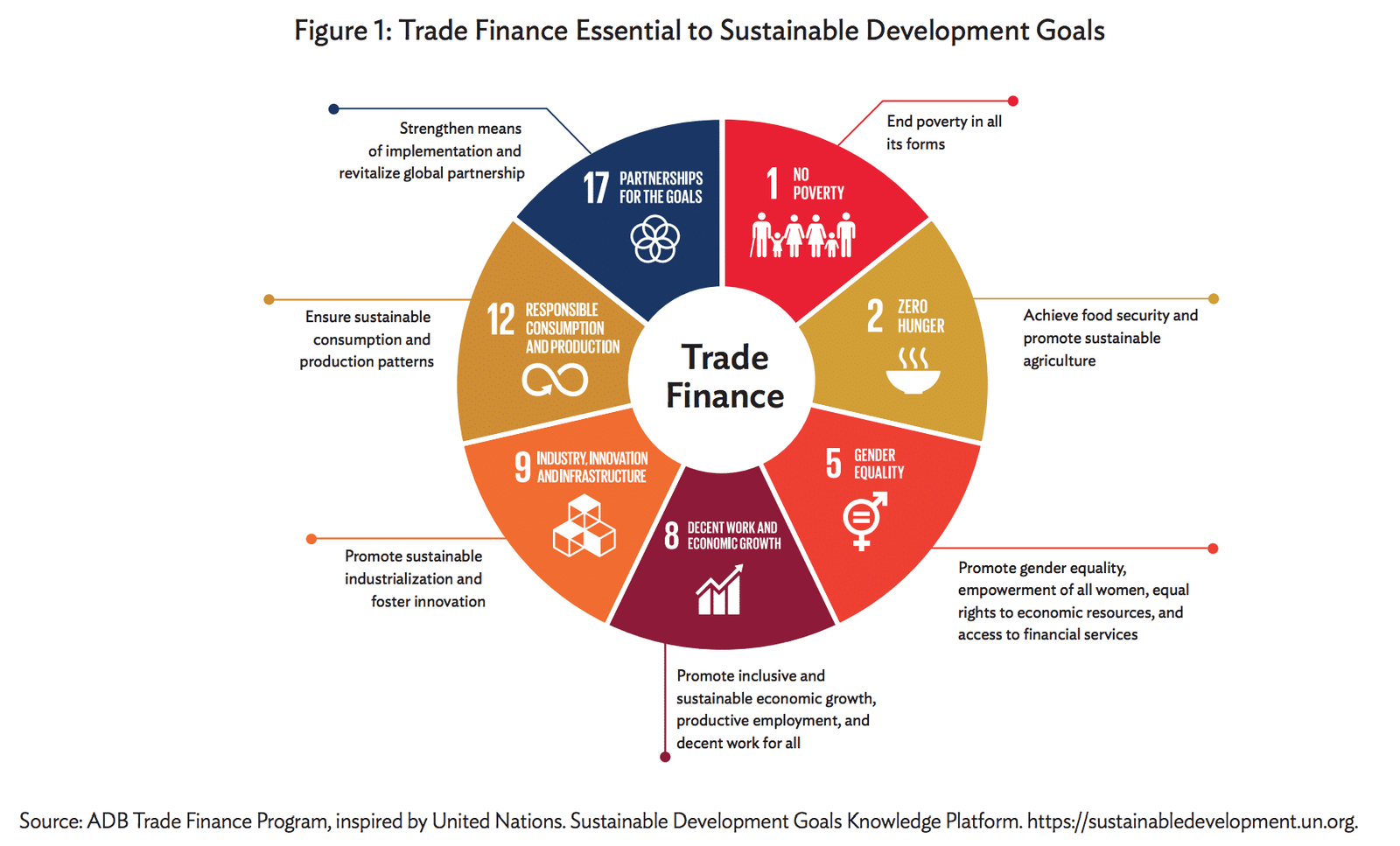

Trade financing is a crucial aspect of international commerce that involves the provision of capital or funding to facilitate various stages of the trading process. It is an umbrella term encompassing a wide range of financial instruments, mechanisms, and services designed to support both domestic and cross-border trade activities. The primary objective of trade financing is to mitigate the inherent risks associated with international trade, such as payment defaults, currency fluctuations, political instability, and logistical challenges.

The significance of trade financing cannot be overstated. It serves as the lifeblood of global trade by enabling businesses to bridge the gap between production and payment cycles.

By providing access to working capital, it empowers exporters and importers to fulfill their contractual obligations promptly. Moreover, trade financing promotes economic growth by fostering increased commercial activity, boosting employment opportunities, and facilitating technological advancements through enhanced market access.

Historical Background and Evolution of Trade Financing

The roots of trade financing can be traced back centuries ago when merchants sought ways to mitigate risks associated with long-distance trading endeavors. In ancient civilizations like Egypt, Mesopotamia, and China, early forms of credit were established through bill systems that facilitated exchange between traders across vast territories.

As global commerce expanded over time with the emergence of maritime routes during the Age of Exploration in the 15th century, new financial instruments emerged to facilitate international transactions. For instance, merchants employed bills of exchange as a means for transferring funds across borders while reducing exposure to risk.

The modern concept of trade financing gained traction during the industrial revolution in Europe when burgeoning global demand necessitated more robust financial solutions for facilitating cross-border commerce. This led to the establishment of specialized institutions such as export credit agencies (ECAs) in various countries.

Over time, traditional methods like letters of credit (LCs) evolved alongside the rise of commercial banking institutions, which began offering a comprehensive range of trade finance products and services tailored to meet the needs of international traders. Today, trade financing has witnessed further transformation through technological advancements and innovations.

The digital era has brought about the advent of supply chain finance (SCF) platforms, allowing for seamless integration between financial institutions and trading partners. Furthermore, sustainable trade financing practices have gained prominence, reflecting the growing importance of environmentally and socially responsible business operations in the global trade landscape.

Types of Trade Financing

Traditional Methods

Trade financing has a rich history, and traditional methods have been the backbone of global commerce for centuries. One such method is the use of Letters of Credit (LC), which provides a secure means of payment for international trade transactions. These letters are issued by banks on behalf of importers and guarantee payment to exporters, ensuring smooth transactions.

Within LCs, there are two prominent types: Documentary LC and Standby LC. Documentary LCs are widely used in international trade as they offer a higher level of protection for both parties involved.

This type requires extensive documentation to be presented before payment can be made. The exporter must provide the necessary commercial documents (invoices, bills of lading, etc.), while the importer must furnish documents related to shipping and clearance.

On the other hand, Standby LCs serve as a guarantee that payment will be made if certain conditions are not met. Unlike Documentary LCs, these are typically utilized in situations where there may be contractual breaches or non-performance by one party.

Another traditional method is through Bills of Exchange (BOE), often known as drafts or promissory notes. BOEs allow exporters to receive payment from importers at a later date while providing security through an unconditional promise to pay.

These negotiable instruments facilitate credit transactions between buyers and sellers across borders. Furthermore, Bank guarantees play an important role in trade financing by offering assurance to the parties involved in a transaction that certain obligations will be fulfilled.

These guarantees can take various forms such as bid bonds, performance guarantees, or advance payment guarantees. By issuing bank guarantees, financial institutions assume responsibility for ensuring that contractual obligations are met if one party fails to fulfill their part.

Modern Methods

In recent times, modern methods have emerged within the realm of trade financing that aim to streamline processes and enhance efficiency further. Supply Chain Finance (SCF) has gained prominence as an effective modern method to provide short-term financing solutions.

It involves collaboration among various stakeholders, such as buyers, suppliers, and financial institutions. One aspect of SCF is Reverse Factoring, where a buyer initiates the process by arranging early payment for their suppliers’ invoices at a discounted rate.

This way, suppliers can access funds sooner and benefit from improved cash flow while the buyer extends favorable payment terms. Another method under SCF is Approved Payables Finance or Supplier Finance.

Here, financial institutions provide funding to suppliers based on approved invoices submitted by the buyer. The supplier can then receive early payment while the buyer makes payments according to agreed terms.

Export Credit Agencies (ECA) play a crucial role in supporting exports and providing trade financing facilities. ECAs are specialized government-backed entities that offer insurance and guarantee programs to exporters and lenders involved in international trade transactions.

They mitigate risks associated with non-payment or political uncertainties in foreign markets, thereby encouraging cross-border trade. Factoring and Invoice Discounting are alternative financing solutions that allow businesses to convert their accounts receivable into immediate cash flow.

Factoring involves selling invoices at a discount to a third-party (factor), who then collects payments directly from debtors. Invoice discounting differs slightly as it allows businesses to retain control over collections while using invoices as collateral for borrowing from financial institutions.

These modern methods have revolutionized trade financing by providing innovative alternatives that cater to different needs within the global trading ecosystem. Their flexibility and adaptability have contributed significantly to fostering growth in international commerce.

International Trade Finance Institutions and Organizations

International trade financing is a complex and dynamic field that relies on the support and guidance of various institutions and organizations. These entities play a crucial role in promoting global trade, ensuring fairness in transactions, and providing valuable resources for businesses engaged in international commerce. Three prominent organizations that significantly contribute to the development of trade financing are the World Trade Organization (WTO), the International Chamber of Commerce (ICC), and the International Finance Corporation (IFC).

World Trade Organization (WTO)

The World Trade Organization, established in 1995, serves as a global forum for negotiating trade agreements, addressing trade disputes, and setting rules governing international commerce. The WTO’s primary objective is to ensure a predictable and transparent trading environment while reducing barriers to trade among member countries.

In relation to trade finance, the WTO advocates for fair practices, monitors developments in financing regulations, encourages financial institutions’ participation in facilitating trade finance activities, and promotes cooperation between governments and financial bodies. The WTO also actively engages in capacity building initiatives by providing technical assistance to developing countries.

This includes training programs aimed at enhancing their understanding of trade finance mechanisms such as letters of credit or bank guarantees. By fostering knowledge exchange and promoting best practices among its members, the WTO plays an instrumental role in strengthening international trade finance.

International Chamber of Commerce (ICC)

The International Chamber of Commerce is an influential institution that represents businesses worldwide across all sectors. Founded more than a century ago, it has become a vital platform for promoting open markets, shaping policy frameworks conducive to cross-border trade, and facilitating dispute resolution through its Arbitration Court.

In terms of international trade financing, the ICC provides essential resources such as uniform rules that govern commercial transactions globally. One notable example is the Uniform Customs And Practice for Documentary Credits (UCP 600), a set of guidelines established by the ICC that standardizes the usage of letters of credit, reducing ambiguity and ensuring uniformity in their application.

The ICC also facilitates discussions and collaboration between financial institutions, governments, and corporations to address emerging challenges in trade finance. Its Banking Commission plays a pivotal role in developing new banking instruments, promoting best practices, and adapting trade finance tools to evolving market needs.

International Finance Corporation (IFC)

As a member of the World Bank Group, the International Finance Corporation is dedicated to promoting sustainable private sector investment in developing countries. The IFC’s primary goal is to alleviate poverty and spur economic growth through investments in various sectors including trade. In the context of international trade financing, the IFC provides financial products and expertise to support businesses engaged in cross-border transactions.

This includes providing loans or guarantees to financial intermediaries such as banks or non-bank financial institutions involved in trade finance activities. Furthermore, the IFC offers advisory services aimed at enhancing operational efficiency and risk management for both financial institutions and businesses seeking access to global markets.

The IFC’s comprehensive approach towards trade financing not only strengthens financial systems but also promotes sustainable development by encouraging responsible business practices and environmental stewardship. By collaborating with organizations like the WTO, ICC, and IFC, businesses can navigate complex international trade environments more effectively while benefiting from standardized procedures, knowledge sharing platforms, and financial resources specifically tailored for their needs.

The Role of Banks in Trade Financing

Commercial banks vs Investment banks in Trade Finance

In the realm of trade financing, both commercial banks and investment banks play vital but distinct roles. Commercial banks are the primary institutions involved in providing trade financing solutions to businesses engaged in international trade. They act as intermediaries between exporters and importers, facilitating smooth transactions by offering a range of services tailored to meet their clients’ needs.

On the other hand, investment banks tend to focus more on complex financial instruments and advisory services rather than directly providing trade finance products. Commercial banks excel at understanding the intricacies of cross-border transactions and possess extensive networks that enable them to effectively manage risks associated with global trading activities.

They typically have dedicated trade finance departments staffed by experts well-versed in the complexities of international trade regulations and documentation. Investment banks, while not as directly involved in day-to-day trade financing operations, may provide specialized advice on structuring deals, commodity price hedging strategies, or arranging syndicated loans for large-scale projects.

Services provided by Banks in Trade Financing

Banks offer a wide array of services related to trade financing that assist businesses throughout the entire supply chain process. These services are crucial for mitigating risks and ensuring smooth execution of cross-border transactions. 1 . Issuing Letters of Credit (LC): One key service provided by banks is issuing letters of credit.

LCs serve as a guarantee from the buyer’s bank to the seller that payment will be made once specified conditions are met, such as presenting required documents or fulfilling contractual obligations. By acting as an intermediary, the bank minimizes risk for both parties involved in the transaction.

2 . Providing Export/Import Loans: Banks also offer various types of loans specifically designed for exporters and importers. Export loans provide funding to manufacturers or traders to fulfill confirmed orders, covering the production and shipment costs.

Import loans, on the other hand, assist importers in managing cash flow by providing funds to pay suppliers before receiving payment from buyers. 3 . Managing Risk through Hedging Instruments: Risk management is an integral part of trade financing, and banks play a crucial role in helping businesses mitigate their exposure to risks such as currency fluctuations or commodity price volatility.

Banks offer hedging instruments such as forward contracts, futures, and options that enable businesses to lock in prices or exchange rates, reducing uncertainty and protecting their profit margins. By providing these services, banks act as trusted partners in trade financing, enabling businesses of all sizes to engage in international trade with confidence and efficiency.

Risk Mitigation Techniques in Trade Financing

Credit Insurance and Export Credit Agencies

In the world of trade financing, risk mitigation is of paramount importance. One effective strategy employed by traders and financial institutions is the utilization of credit insurance and export credit agencies (ECAs). Credit insurance provides a safeguard against the potential default or insolvency of buyers, ensuring that sellers receive payment for their goods or services.

This type of insurance helps minimize the risk associated with non-payment by transferring it to an insurer. In case a buyer fails to fulfill its payment obligations, the insurer reimburses the exporter for any losses incurred.

Export credit agencies, on the other hand, play a pivotal role in facilitating international trade by providing financial support and risk coverage. These government-backed institutions offer various types of guarantees and insurance products to exporters, including export credit guarantees and export credit insurance.

These tools help exporters mitigate risks associated with non-payment, political instability, or foreign currency fluctuations. By offering financing solutions such as working capital loans or loan guarantees to buyers abroad, ECAs enable exporters to expand their market reach while minimizing potential financial setbacks.

Hedging Instruments: Forward Contracts, Futures, Options

Another crucial aspect of risk mitigation in trade financing lies in hedging instruments such as forward contracts, futures contracts, and options. These financial derivatives allow traders to protect themselves against adverse price movements in currencies or commodities that could negatively impact their profit margins.

Forward contracts provide a straightforward means of mitigating exchange rate risk by locking in a specific exchange rate for future transactions. By entering into these agreements with counterparties willing to buy or sell currencies at pre-determined rates on specified dates, traders can hedge against potential losses resulting from currency fluctuations.

Futures contracts are similar to forward contracts but are standardized and traded on organized exchanges. They enable market participants to speculate on future prices and hedge against price volatility.

These contracts ensure a predetermined price and delivery date, reducing uncertainty and facilitating smoother trade execution. Options offer traders the right, but not the obligation, to buy or sell currencies or commodities at a predetermined price within a specified period.

They provide flexibility by allowing traders to choose whether to exercise the option based on market conditions. Options are particularly useful for managing risk associated with uncertain price movements or unexpected events that could impact trade financing.

By utilizing credit insurance, export credit agencies, and hedging instruments like forward contracts, futures contracts, and options, traders can effectively mitigate risks in trade financing. These techniques provide valuable tools to safeguard against potential financial losses and ensure smoother international transactions in an increasingly volatile global market.

Emerging Trends in Trade Financing

Technological Advancements: Blockchain Technology, Smart Contracts

In recent years, technological advancements have significantly impacted the landscape of trade financing. One of the most noteworthy developments is the emergence of blockchain technology. Blockchain is a decentralized digital ledger that allows for transparent and secure recording of transactions.

Its potential in trade financing lies in its ability to streamline and automate processes, reduce fraud, and increase efficiency. With blockchain technology, trade finance documentation such as letters of credit and bills of lading can be digitized, eliminating the need for manual processing and reducing paperwork.

Smart contracts, a self-executing contract with predefined terms written into code on the blockchain, provide added security by ensuring compliance with agreed-upon conditions before funds or goods are released. This enables parties involved in trade financing transactions to have greater trust, reduced delays, and lower costs.

While still in its nascent stages, blockchain technology has already shown immense promise in transforming how trade financing operates. By increasing transparency and trust among participants through secure data sharing and automating processes through smart contracts on a tamper-proof ledger system, this technology has the potential to revolutionize the way international trade is financed.

Sustainable Trade Financing Practices

In today’s global economy where environmental concerns are at the forefront of discussions, sustainable trade financing practices are gaining traction. With an emphasis on responsible business conduct and environmental stewardship, companies are increasingly looking for ways to align their financial activities with sustainable goals.

One significant trend within sustainable trade financing is green finance. Green finance refers to financial products or services that support environmentally friendly projects or businesses that mitigate climate change risks.

In trade financing specifically, green finance can involve funding for renewable energy projects or supporting environmentally conscious supply chains. Furthermore, ethical lending practices are becoming more prevalent as investors demand greater accountability from financial institutions.

Banks and other lenders are scrutinizing the environmental and social impacts of trade financing projects to ensure they align with international standards and guidelines. By incorporating sustainable practices into trade financing, companies not only contribute to environmental preservation but also demonstrate good corporate citizenship, which can enhance their reputation and attract socially responsible investors.

Non-Banking Financial Institutions Entering the Market

Traditionally, banks have been the primary players in trade financing. However, recent trends indicate a shift with the entry of non-banking financial institutions into the market.

This expansion is driven by various factors such as regulatory changes, technological advancements, and increasing demand for alternative financing options. One example of non-banking institutions entering the trade financing arena is fintech companies.

Fintech refers to technology-driven financial services that offer innovative solutions to traditional banking practices. These companies utilize advanced algorithms and digital platforms to provide efficient and accessible trade finance options for businesses.

Through their user-friendly interfaces, streamlined processes, and data analytics capabilities, fintech firms are disrupting traditional banking models. Moreover, institutional investors are also exploring opportunities in trade finance as they seek diversification in their investment portfolios.

These investors provide capital directly to companies involved in global trade or invest through specialized funds that focus on trade finance assets. The entry of non-banking financial institutions brings competition and innovation to the trade financing sector.

It broadens access to funding for businesses while driving efficiency through technology-driven solutions. As this trend continues to evolve, collaborations between traditional banks and non-bank entities may emerge as partnerships become mutually beneficial in leveraging respective strengths.

Emerging trends in trade financing encompass technological advancements like blockchain technology and smart contracts that streamline processes while ensuring transparency and security. Sustainable practices are gaining momentum as companies aim to align their financial activities with environmental goals.

Additionally, non-banking financial institutions are entering the market, disrupting traditional banking models by offering innovative solutions that enhance accessibility and efficiency in trade financing transactions. These trends present both opportunities and challenges in reshaping the future of trade finance.

Case Studies on Successful Trade Financing Deals

The role of trade financing in large-scale infrastructure projects

When it comes to undertaking large-scale infrastructure projects, trade financing plays a pivotal role in facilitating their successful implementation. These projects require substantial financial resources and often involve multiple parties across different countries. Trade financing provides the necessary support by offering various instruments such as letters of credit and bank guarantees to mitigate risk and create a secure environment for all stakeholders involved.

For example, in the construction of a major highway project spanning multiple countries, trade financing enables suppliers to receive payment upon completion of agreed-upon milestones, ensuring continuous cash flow throughout the project duration. Additionally, trade finance instruments like performance bonds allow contractors to provide guarantees to project owners, assuring timely completion and adherence to quality standards.

How small businesses benefit from innovative trade financing solutions

Innovative trade financing solutions have opened up new possibilities for small businesses in the global market. Traditionally, smaller enterprises faced challenges accessing affordable capital for international transactions due to limited credit history or collateral requirements.

However, with the advent of supply chain finance (SCF) and factoring services, these obstacles have been largely overcome. Small businesses can now take advantage of SCF programs offered by large corporations where invoices are discounted at favorable rates based on the buyer’s creditworthiness rather than their own.

This allows them to access working capital quickly and efficiently while reducing their dependence on expensive short-term loans. Additionally, technology-driven platforms that connect small businesses with non-banking financial institutions offer alternative funding options specifically tailored to their needs.

Peer-to-peer lending platforms match borrowers directly with lenders willing to provide trade finance solutions without traditional intermediaries. These platforms not only streamline the process but also allow borrowers to secure competitive interest rates based on their creditworthiness and business potential.

Conclusion

Trade financing has proven to be an indispensable tool in driving economic growth and fostering international trade. Through a variety of traditional and modern methods, it enables smooth business transactions, mitigates risks, and supports businesses of all sizes. Whether it is financing large-scale infrastructure projects or empowering small enterprises, trade financing plays a vital role in overcoming financial barriers and unlocking new opportunities for global commerce.

Despite the complex nature of trade financing, advancements in technology and the emergence of innovative financial solutions have made it more accessible than ever before. As we move forward, it is essential for governments, financial institutions, and businesses to collaborate and further enhance trade finance practices.

With continued innovation, increased transparency, and broader access to funding options for businesses around the world, the future of trade financing looks promising. It is through such collective efforts that we can foster economic prosperity while ensuring a level playing field for all participants in the global marketplace.