What is crowdfunding & how does it work?

Welcome, esteemed readers, to an exploration of the captivating realm of crowdfunding. In this age of boundless connectivity and entrepreneurial ingenuity, crowdfunding has emerged as a powerful tool that enables individuals and organizations to raise funds for their innovative projects or noble causes. By harnessing the collective financial support of a large number of individuals, crowdfunding revolutionizes traditional fundraising methods and democratizes access to capital.

Definition of Crowdfunding

Crowdfunding can be described as a method of fundraising where a diverse community of contributors, commonly referred to as “the crowd,” pool their resources to financially support ventures or initiatives. These undertakings can range from creative projects like films or music albums to social causes such as disaster relief efforts or medical expenses.

Crucially, crowdfunding platforms serve as intermediaries that connect project creators with potential backers who are motivated by a shared enthusiasm for the proposed endeavor. The spirit of crowdfunding lies in its ability to unite people around common goals and aspirations.

It empowers dreamers, innovators, and changemakers by offering them an alternative path for funding their ventures beyond traditional institutions like banks or venture capitalists. By embracing the principles of inclusivity and collaboration, crowdfunding allows both established entrepreneurs and aspiring visionaries alike to tap into the vast potential that resides within an engaged community.

Brief History and Evolution of Crowdfunding

To truly appreciate the transformative impact that crowdfunding has had on modern society, it is essential to examine its historical roots and trace its evolution over time. While the concept itself is deeply rooted in human generosity and collective action, the advent of digital technology provided a catalyst for its rapid growth.

One could argue that the first instances resembling modern-day crowdfunding can be traced back through centuries-old practices such as subscription-based funding models used by artists in Renaissance Europe or communities pooling resources for communal projects. However, it was not until the early 2000s that crowdfunding as we know it today started gaining prominence, primarily driven by the convergence of social media, e-commerce platforms, and online payment systems.

Some notable milestones in the evolution of crowdfunding include the launch of ArtistShare in 2003, which pioneered a reward-based crowdfunding model specifically catering to artists and musicians. In 2006, Kiva introduced a donation-based model to connect lenders with entrepreneurs in developing countries.

The turning point came with the establishment of Kickstarter in 2009, which popularized reward-based crowdfunding for creative projects and brought this innovative funding mechanism to mainstream attention. Over time, crowdfunding has evolved beyond individual projects to encompass a wide range of categories such as technology startups (through equity-based models), philanthropy (through donation-based platforms), and personal lending (via peer-to-peer lending platforms).

The crowdfunding ecosystem continues to expand and diversify with new specialized platforms catering to specific sectors or niches. This powerful financial tool has become an essential part of twenty-first-century economic landscape, empowering creators and investors alike.

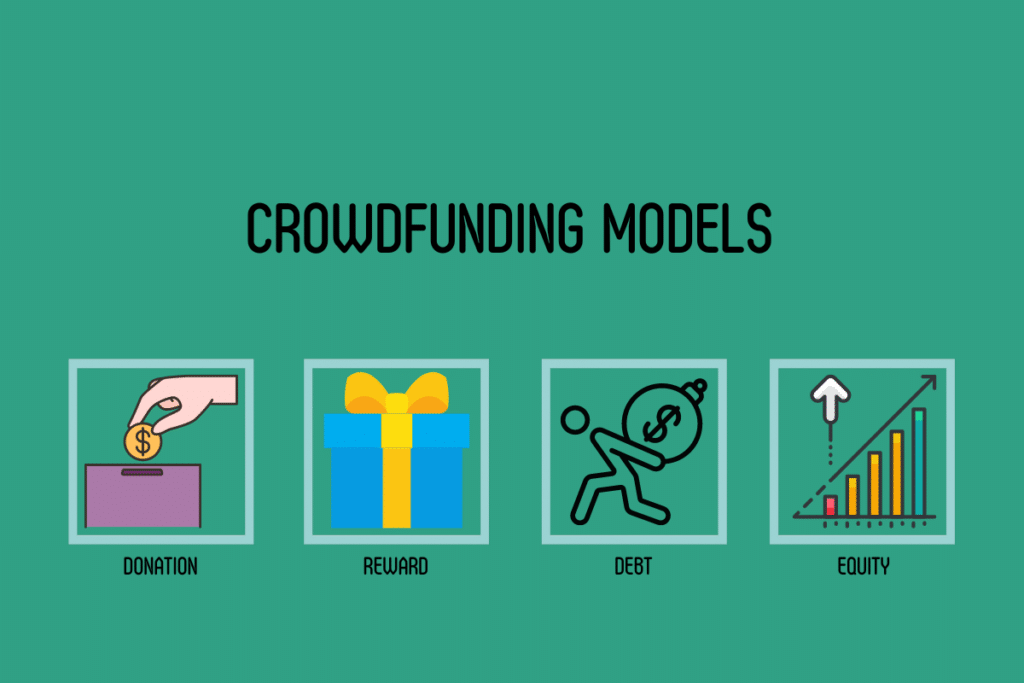

Types of Crowdfunding

Donation-based Crowdfunding: Examples and Use Cases

Donation-based crowdfunding is a form of crowdfunding where individuals contribute funds to support a cause or project without expecting financial returns. It has gained significant popularity as a means to rally support for charitable, artistic, or social initiatives. Platforms like GoFundMe and Kickstarter have facilitated countless successful donation-based campaigns.

One prominent example of donation-based crowdfunding is the ALS Ice Bucket Challenge that took social media by storm in 2014. This campaign aimed to raise awareness and funds for amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s disease.

Participants would pour a bucket of ice water over their heads, capture it on video, and challenge others to do the same while making a donation to ALS research. This viral campaign succeeded in raising an incredible $115 million globally, significantly accelerating research efforts towards finding a cure.

While donation-based crowdfunding provides an accessible way for individuals and organizations to gather financial support from a large pool of potential donors, it does come with certain limitations. One challenge is sustaining donor engagement beyond the initial campaign frenzy.

Often, donors may not contribute again once their one-time contribution is made. Additionally, as no financial returns are expected with this type of crowdfunding, it may not be suitable for businesses seeking investment capital or individuals looking for personal financial gains.

Reward-based Crowdfunding: Overview of How It Works

Reward-based crowdfunding offers backers tangible rewards or incentives in exchange for their contributions. This model allows creators and entrepreneurs to launch campaigns showcasing their products or projects before they hit the market while offering unique perks that motivate backers to contribute.

Platforms like Indiegogo and Kickstarter have become synonymous with reward-based crowdfunding due to their success in enabling numerous creative projects across various domains. Creators set specific funding goals within defined timelines and offer tiered rewards based on contribution levels.

For instance, a band seeking funding to produce their album might offer a digital download of the album for lower-tier contributions, while higher tiers could include signed merchandise or exclusive access to concerts. One notable success story in reward-based crowdfunding is the Pebble Time smartwatch.

Pebble Technology Corporation launched its campaign on Kickstarter in 2015 with the aim of raising $500,000. However, the campaign surpassed all expectations and ended up securing over $20 million from more than 78,000 backers.

The reward model allowed early supporters to secure one of the first Pebble Time smartwatches at a discounted price, creating a sense of exclusivity and excitement among tech enthusiasts. Reward-based crowdfunding presents an opportunity for creators to validate their ideas, generate pre-sales, and engage with their target audience before bringing their product or project to market.

However, it is crucial for campaign organizers to set realistic goals and deliver on promised rewards within specified timelines. Failure to do so can damage trust and reputation among backers and potentially harm future ventures.

Equity-based Crowdfunding: Explanation of Equity Participation Model

Equity-based crowdfunding involves raising capital by offering shares or ownership stakes in a business venture. It allows small businesses and startups to access investment opportunities without relying solely on traditional sources like venture capitalists or angel investors. The equity participation model works by connecting entrepreneurs with potential investors through dedicated platforms like SeedInvest or CircleUp.

These platforms facilitate due diligence processes, help set investment terms, and provide legal frameworks necessary for offering securities to the public. When participating in an equity-based crowdfunding campaign as an investor, individuals contribute funds in exchange for equity shares proportional to their investment size.

Instead of receiving immediate financial returns like interest payments or dividends, investors look forward to potential capital gains if the company grows successfully and ultimately exits through avenues such as acquisition or initial public offering (IPO). However promising it may sound, equity-based crowdfunding raises regulatory considerations to protect both investors and entrepreneurs.

Governments worldwide have implemented securities laws and regulations to ensure transparency, prevent fraud, and safeguard investor interests. Compliance with these regulations is crucial for businesses seeking to utilize equity-based crowdfunding as a fundraising method.

Debt-based Crowdfunding (Peer-to-Peer Lending): Concept of Borrowing Money from the Crowd

Debt-based crowdfunding, commonly known as peer-to-peer lending or P2P lending, enables individuals or businesses to borrow money directly from a pool of lenders through online platforms like Prosper or LendingClub. This alternative financing model eliminates the need for traditional banking intermediaries, allowing borrowers to access funds quickly while providing lenders with potential returns through interest payments. In this model, borrowers apply for loans by submitting their personal or business information on the platform.

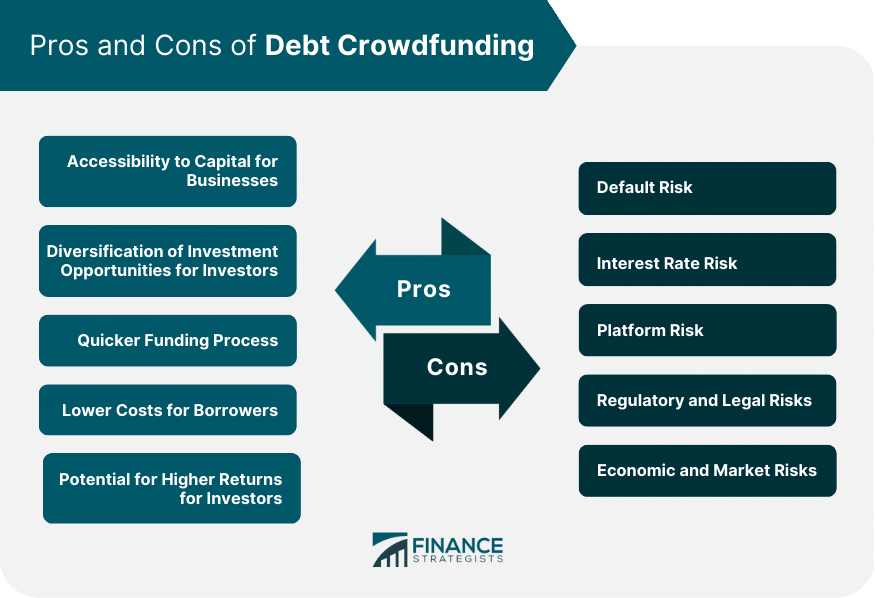

Based on creditworthiness assessments conducted by the platform or assigned credit rating agencies, lenders decide whether to fund a particular loan request and at what interest rate. The advantages of debt-based crowdfunding are numerous for both borrowers and lenders.

For borrowers facing difficulties obtaining loans through traditional channels due to limited credit history or stringent requirements, P2P lending offers an accessible avenue for obtaining necessary capital. Additionally, borrowers may benefit from potentially lower interest rates compared to traditional financial institutions.

On the other hand, P2P lending can be an attractive investment option for lenders seeking diversification in their portfolio and higher returns than those offered by savings accounts or government bonds. By investing in multiple loans across different risk profiles, lenders can spread their investment risks while supporting individuals or small businesses that might not have qualified for conventional loans.

However, it is important for both parties involved in P2P lending transactions to assess risks carefully. Borrowers should consider their repayment abilities and evaluate interest rates against other available options before taking on debt obligations.

Lenders must also understand that P2P lending carries inherent risks such as borrower default and should diversify their investments accordingly to mitigate potential losses. Crowdfunding encompasses various models that cater to different needs and goals.

Whether it is for donations, rewards, equity participation, or borrowing money directly from individuals, each type of crowdfunding presents its own benefits and limitations. By understanding the nuances of these models and aligning them with specific objectives, both project creators and backers can harness the power of the crowd to bring ideas to life, support causes, or foster financial growth.

The Crowdfunding Process

Planning a Campaign: Defining Goals, Target Audience, and Rewards/Incentives

When embarking on a crowdfunding campaign, meticulous planning is essential for success. The first step is to define clear goals that outline the purpose and desired outcomes of the campaign.

Whether it is funding a creative project, supporting a charitable cause, or launching a business venture, clearly articulating the objectives helps attract potential backers who align with the vision. Additionally, identifying the target audience ensures that efforts are focused on reaching those most likely to resonate with the campaign’s message.

To entice backers and encourage their participation, designing attractive rewards or incentives plays a crucial role. These can range from exclusive merchandise related to the project or cause to personalized experiences or early access to products/services.

The incentives should be enticing enough to motivate people to contribute while aligning with the overall campaign theme. Providing various tiers of rewards allows for inclusivity and accommodates backers with different budget preferences.

Creating an Engaging Campaign Page

A well-crafted campaign page acts as a virtual storefront that showcases the essence of your project or cause in an engaging manner. It should be visually appealing and easy to navigate, capturing visitors’ attention from their first glance. Begin by crafting an attention-grabbing headline that summarizes your mission concisely but compellingly.

Next, provide detailed information about your project’s background, explaining its significance and potential impact on both individuals and society at large. Utilize persuasive language that speaks directly to potential backers’ emotions while highlighting unique selling points.

Visual aids such as images, videos, charts, and infographics can further enhance your campaign page’s appeal by conveying information in an easily digestible format. Incorporate testimonials or success stories from individuals who have benefited from similar projects in order to build trust and credibility.

Make sure your call-to-action (CTA) is prominently displayed, guiding visitors towards contributing to your campaign. Include clear instructions on how they can get involved and emphasize the urgency or limited-time opportunity to create a sense of immediacy.

Campaign Launch: Promoting Through Social Media, Email Marketing, etc.

Once the campaign page is meticulously crafted, it’s time for the much-anticipated launch. A multi-faceted promotion strategy is key to reaching potential backers and generating buzz around the campaign.

Social media platforms like Facebook, Twitter, Instagram, and LinkedIn offer powerful avenues for spreading the word. Create engaging posts that incorporate captivating visuals and persuasive captions related to your project or cause.

Leverage email marketing by utilizing your existing contact list and reaching out to friends, family members, colleagues, and other connections who may be interested in supporting your endeavor. Personalized emails with heartfelt messages tend to have a stronger impact than generic mass emails.

In addition to these digital channels, consider offline promotion as well. Engage with local communities through events or partnerships with relevant organizations or influencers who share mutual interests.

Building momentum during the campaign is crucial for its success. Regularly update your audience on progress made toward goals using storytelling techniques that evoke emotions and inspire continued support.

Share success stories of individuals impacted by similar projects or causes and highlight milestones achieved along the way. This ongoing narrative builds trust and motivates both current backers and potential supporters to spread the word about your campaign.

Managing the Campaign: Communicating with Backers/Supporters

Effective communication plays a pivotal role in maintaining transparency and building strong relationships with backers throughout the campaign journey. Responding promptly to queries, comments, or concerns demonstrates attentiveness while fostering a sense of community among those invested in your project or cause.

Sending regular updates through various channels keeps backers informed about progress made towards goals while providing an opportunity for gratitude expressions. Share stories of how their contributions have made a difference and demonstrate that their support is valued.

Utilize newsletters, social media posts, or personalized emails to keep them engaged and excited about the project’s development. Feedback from backers is invaluable for improving campaign strategies in real-time.

Encourage them to share suggestions or ideas for enhancing the project’s impact or fundraising efforts. Actively listening to their input and implementing relevant changes not only increases the chances of campaign success but also strengthens trust and credibility within the community.

Campaign Completion: Fulfilling Rewards/Incentives to Backers

As your campaign reaches its completion, it’s crucial to deliver on your promises by fulfilling the rewards/incentives offered to backers promptly. Ensure that each reward is thoughtfully prepared and of high quality, as this reflects directly on your integrity and commitment. Maintain open lines of communication throughout this process by providing updates on reward fulfillment progress.

Address any potential delays or obstacles transparently, establishing trust with your backers. Express gratitude through personalized messages, acknowledging each individual’s contribution and emphasizing how their support has been fundamental in achieving campaign goals.

Post-campaign activities encompass reporting back to backers about how funds were utilized or allocated according to the initially outlined goals. Provide detailed information on accomplishments achieved with the crowdfunding proceeds, sharing specific impact metrics whenever possible.

This level of accountability enhances transparency and keeps supporters engaged while showcasing successful outcomes resulting from their involvement. In addition, consider nurturing relationships with backers beyond the initial campaign by keeping them informed about future milestones or initiatives related to your project or cause.

Encourage ongoing engagement through newsletters, social media updates, or exclusive events tailored specifically for those who contributed during the crowdfunding phase. By following these meticulous steps throughout the crowdfunding process – from planning to completion – you can maximize your chances of achieving success while creating a thriving community around your project or cause.

Crowdfunding Success Factors

Compelling Storytelling: The Power of Emotional Connection

One of the key success factors in crowdfunding is the ability to tell a compelling story that resonates with potential backers. Embracing the power of emotional connection can be incredibly impactful in garnering support.

When crafting a campaign, it is important to showcase not just the practical aspects of your project or venture, but also its underlying purpose and personal relevance. By conveying a genuine and heartfelt narrative, you can evoke empathy and forge an emotional bond with your audience, motivating them to become advocates for your cause.

Tapping into Personal Networks: Crowdfunding campaigns often rely on personal networks to gain traction.

Your friends, family, colleagues, and acquaintances are natural starting points for spreading awareness about your project. Moreover, tapping into their networks expands your reach exponentially.

Actively engaging with your personal network by sharing updates on social media platforms, hosting gatherings or events related to your campaign, and personally reaching out to individuals can significantly increase the chances of success. Remember that word-of-mouth recommendations carry immense weight in crowdfunding endeavors.

Strategic Planning: Setting Realistic Funding Goals

Setting realistic funding goals is crucial for attracting potential backers and ensuring campaign success. While it may be tempting to aim high right from the start, unrealistic targets can deter supporters who may question whether their contributions will truly make an impact. Conducting thorough research on similar projects or ventures within your niche can help gauge what is attainable within a given timeframe.

It’s essential to consider expenses beyond just production costs such as marketing efforts or shipping logistics when determining funding goals. Effective Marketing Strategies:

A well-executed marketing strategy plays a pivotal role in promoting crowdfunding campaigns effectively. Utilizing various digital channels such as social media platforms (Facebook groups, Twitter hashtags), email newsletters targeting specific demographics or interests (segmented lists), and collaborations with influencers or organizations relevant to your project can maximize exposure.

Eye-catching visuals, engaging video content, and concise messaging are crucial components in capturing the attention of potential backers amidst the vast sea of crowdfunding campaigns. Additionally, leveraging press releases or media coverage can amplify campaign visibility and generate buzz.

Transparency and Trust: Communication with Backers

Transparency is paramount to build trust with your backers. Regularly communicate updates on the progress of your project, setbacks encountered, and how funds are being utilized.

Openly addressing challenges demonstrates accountability and reassures supporters that their contributions are being respected. Promptly responding to inquiries or concerns fosters a positive relationship with backers, fostering a sense of community around your project.

Conclusion

Crowdfunding can be a powerful tool for individuals or organizations seeking financial support for their projects or ventures. By harnessing the art of compelling storytelling, tapping into personal networks, employing strategic planning techniques such as setting realistic funding goals and implementing effective marketing strategies, while maintaining transparency and building trust through open communication with backers – one can greatly enhance their chances of achieving crowdfunding success.

With dedication, creativity, and unwavering persistence in connecting with potential supporters on an emotional level while offering them a clear vision of what their contributions will achieve – crowdfunding provides an opportunity for dreams to become reality. By embracing these success factors outlined above, you can embark on a crowdfunding journey filled with hope, optimism, and the possibility of turning innovative ideas into remarkable accomplishments.