Loan Information

Definition of a Loan

A loan can be defined as a financial transaction in which a lender provides funds to a borrower, with the expectation that the borrower will repay the borrowed amount along with any applicable interest or fees within a specified period. Loans are typically used by individuals, businesses, and governments to meet their financial needs when they lack sufficient funds of their own. The borrowed money can be utilized for various purposes such as purchasing assets (like homes or vehicles), funding education, expanding business operations, or even managing unforeseen expenses.

Importance of Loans in Financial Transactions

Loans play an indispensable role in the realm of finance, serving as catalysts for economic growth and progress. They enable individuals and entities to pursue opportunities that would otherwise be out of reach due to financial constraints. By providing access to capital, loans empower borrowers to make investments, expand businesses, acquire assets, and enhance their overall quality of life.

Moreover, loans facilitate consumption by allowing individuals to make significant purchases upfront and repay them over time. In addition to empowering borrowers, loans also contribute to the stability and smooth functioning of financial markets.

Lenders earn interest on the principal amount they lend out, generating income for themselves while fueling economic activity through interest payments made by borrowers. This symbiotic relationship between lenders and borrowers forms the foundation of modern economies around the world.

Historical Background of Loans

The concept of lending dates back thousands of years when communities relied on informal systems for borrowing and lending resources. In ancient civilizations such as Mesopotamia and Egypt, loan agreements were documented on clay tablets or papyrus scrolls.

These early forms of credit played a crucial role in facilitating trade and commerce. As societies evolved and formalized their financial systems, lending practices became more structured.

In medieval Europe during the Middle Ages, lending was primarily dominated by religious institutions, such as monasteries and the Catholic Church. These institutions provided loans to support agricultural activities and assist local communities.

With the advent of modern banking in the 17th century, loans became more widespread and accessible. The establishment of banks allowed for greater financial intermediation, enabling individuals to borrow from institutionalized lenders rather than relying solely on personal connections or informal arrangements.

Today, loans are an integral part of the global financial system, with a multitude of lenders offering diverse loan products catered to specific needs and circumstances. The evolution of loan practices throughout history reflects their enduring significance in facilitating economic growth and prosperity.

Types of Loans

Secured Loans

Secured loans are a type of loan that requires borrowers to provide collateral as a form of security for the lender. Collateral is an asset or property that borrowers pledge to give the lender in case they fail to repay the loan. Two common examples of secured loans are mortgages and auto loans.

A mortgage is a loan used to finance the purchase of real estate. When individuals buy a house using a mortgage, the property itself serves as collateral for the loan.

If borrowers default on their mortgage payments, the lender has the right to foreclose on the property and sell it to recoup their investment. Auto loans, on the other hand, are loans used specifically for purchasing vehicles.

In this case, the car being financed serves as collateral for the loan. If borrowers fail to make their payments, lenders have legal recourse to repossess and sell their vehicle.

Secured loans offer several advantages and disadvantages. The main advantage is that they often come with lower interest rates compared to unsecured loans because lenders have an added layer of security through collateral.

Additionally, secured loans may allow borrowers access to higher loan amounts since lenders have more confidence in recovering their funds. However, one significant disadvantage is that if borrowers default on payments, they risk losing their collateralized asset permanently.

Unsecured Loans

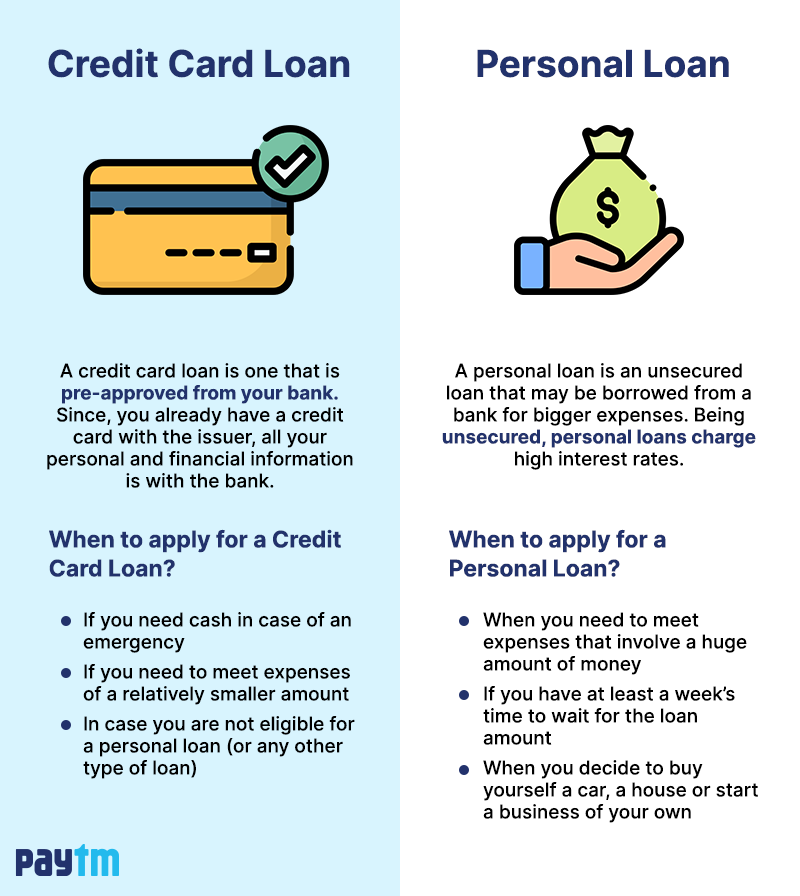

Unsecured loans are a type of loan granted solely based on a borrower’s creditworthiness without requiring any form of collateral or asset backing. Examples of unsecured loans include personal loans and credit cards. Personal loans are typically used for various purposes such as financing home improvements or consolidating debt.

These types of loans do not require any specific assets as security but rely heavily on a borrower’s credit history and income stability. Credit cards operate similarly in terms of being unsecured forms of credit readily available for use by individuals.

Unlike personal loans, credit cards provide a revolving line of credit that borrowers can access repeatedly within their approved credit limit. However, the interest rates on credit card balances tend to be higher than those of personal loans.

One advantage of unsecured loans is the absence of collateral requirements, which means borrowers do not risk losing any assets in case of default. Additionally, unsecured loans typically have a faster application process and disbursal time compared to secured loans.

However, they come with higher interest rates due to the increased risk for lenders. Moreover, eligibility for unsecured loans heavily relies on a borrower’s creditworthiness and income stability, making them more challenging to obtain for individuals with poor credit or limited income.

Loan Application Process

Preparing for a Loan Application

Before diving into the loan application process, it is crucial to gather all the necessary documents. Lenders typically require proof of income, such as pay stubs or tax returns, to assess your ability to repay the loan. Additionally, identification documents like a driver’s license or passport are needed for verification purposes.

By gathering these documents beforehand, you can streamline the application process and prevent any unnecessary delays. Another essential step is assessing your credit score.

Your credit score plays a significant role in determining your eligibility for a loan and the interest rate you’ll receive. If your credit score needs improvement, take proactive measures to boost it before applying for a loan.

This can be achieved by paying bills on time, reducing outstanding debts, and correcting any errors on your credit report. By improving your creditworthiness before submitting an application, you increase your chances of obtaining favorable loan terms.

Choosing the Right Lender/Institution

Researching different lenders is paramount when seeking a loan as it allows you to find one that best suits your financial needs. Start by exploring traditional options such as banks and credit unions but don’t overlook online lenders that may offer competitive rates and convenient application processes.

When comparing lenders, pay close attention to interest rates, terms, and fees associated with each option. Interest rates directly impact the overall cost of borrowing while terms determine how long you have to repay the loan in full.

Be mindful of fees such as origination fees or prepayment penalties that could significantly affect the total amount repaid over time. Taking time to research multiple lenders ensures that you make an informed decision based on understanding all available options and selecting one that aligns with both short-term requirements and long-term financial goals.

Loan Application Steps

1: Filling out the application form accurately Completing the loan application form accurately is crucial to provide the lender with all necessary information. This includes personal details, such as your name, address, contact information, and Social Security number.

Providing correct employment history details is equally important to help lenders evaluate your stability and ability to repay the loan. Financial information disclosure is a critical aspect of the application process.

It involves listing your assets and liabilities, including income sources and existing debts. Lenders utilize this information to assess your debt-to-income ratio, which influences their decision-making process.

Approval Process & Underwriting

Once you submit your loan application, the lender initiates the approval process and underwriting stage. During this phase, they evaluate your creditworthiness through a comprehensive review of your credit history, including factors like credit score, payment history, and outstanding debts.

They also verify your income by requesting supporting documents like bank statements or tax returns. The underwriting process involves assessing risks associated with lending you money based on their internal criteria.

Lenders consider various factors such as employment stability and your ability to manage debt obligations responsibly. It’s worth noting that each lender may have different underwriting guidelines depending on their risk appetite.

Loan Disbursement & Repayment Terms

After successfully completing the approval process, it’s time for loan disbursement—where funds are transferred to you. Depending on the lender’s procedures, this could be done via direct deposit into a designated bank account or through checks provided by them. As for repayment options, lenders typically offer various choices tailored to borrowers’ needs.

Monthly installments are common for fixed-rate loans where you pay off both principal and interest portions over a set period. However, other repayment structures might exist depending on the type of loan obtained.

It’s essential to discuss repayment terms upfront with the lender—understand how interest rates may fluctuate (in case of adjustable-rate loans) and evaluate potential penalties for late payments or early repayment. Clear communication about repayment expectations ensures a smooth borrowing experience.

Loan Repayment Strategies & Options

A: Standard Repayment Plan The standard repayment plan is the most common approach for loan repayment. Under this arrangement, you make fixed monthly payments over the loan term.

These payments include both principal and interest amounts, ensuring the loan balance decreases steadily until it is fully repaid. B: Graduated Repayment Plan

The graduated repayment plan offers flexibility to borrowers by starting with lower monthly payments that gradually increase over time. This option is suitable for individuals with a lower income at the beginning of their careers, allowing them to manage their financial obligations more comfortably in the initial years.

Conclusion: Embarking on a loan application process can be overwhelming, but with adequate preparation and research, it becomes manageable.

Remember to gather all necessary documents, assess your credit score before applying, and thoroughly compare different lenders’ offerings. By accurately filling out the application form, understanding the approval process and underwriting criteria, and discussing loan disbursement and repayment terms in detail, you set yourself up for success in obtaining a loan that suits your needs.

While loans involve financial responsibility, they also present opportunities for growth and progress. By utilizing loans wisely – whether through standard or graduated repayment plans – individuals can achieve their goals while building creditworthiness.

The key lies in understanding one’s financial situation thoroughly and selecting appropriate strategies tailored to individual circumstances. With discipline and effective management of borrowed funds, loans can serve as stepping stones towards achieving dreams while strengthening personal financial well-being.