Creditworthiness

Definition and Importance of Creditworthiness

Creditworthiness, in its essence, refers to the assessment of an individual’s or entity’s ability to fulfill their financial obligations. It is a measure of one’s reliability in repaying borrowed funds or meeting contractual commitments promptly and responsibly.

Creditworthiness is a critical factor that lenders, financial institutions, and even potential business partners consider before engaging in any financial transaction. To assess creditworthiness, various indicators are evaluated, such as payment history, credit utilization ratio, length of credit history, and types of accounts held.

These factors provide insight into an individual’s past financial behavior and serve as predictors of their future actions. A high level of creditworthiness indicates a lower risk associated with lending or doing business with the person or entity.

Role of Creditworthiness in Financial Transactions

Creditworthiness serves as the foundation for all financial transactions involving borrowing or extending credit. Whether applying for a mortgage loan to purchase a home or seeking a line of credit for business expansion, having good creditworthiness opens doors to favorable terms and increased opportunities.

Lenders heavily rely on creditworthiness assessments when determining interest rates on loans. Borrowers with excellent credit scores often enjoy lower interest rates due to their perceived reliability in honoring repayment terms.

Conversely, individuals with poor credit may face higher interest rates as they are deemed riskier borrowers. Moreover, creditworthy individuals gain access to larger lines of credit or higher loan amounts compared to those with lower ratings.

This becomes particularly crucial when considering significant investments like purchasing real estate or starting a new business venture that requires substantial capital. Understanding what constitutes strong creditworthiness and recognizing its significance in financial interactions empowers individuals and entities alike throughout their monetary endeavors.

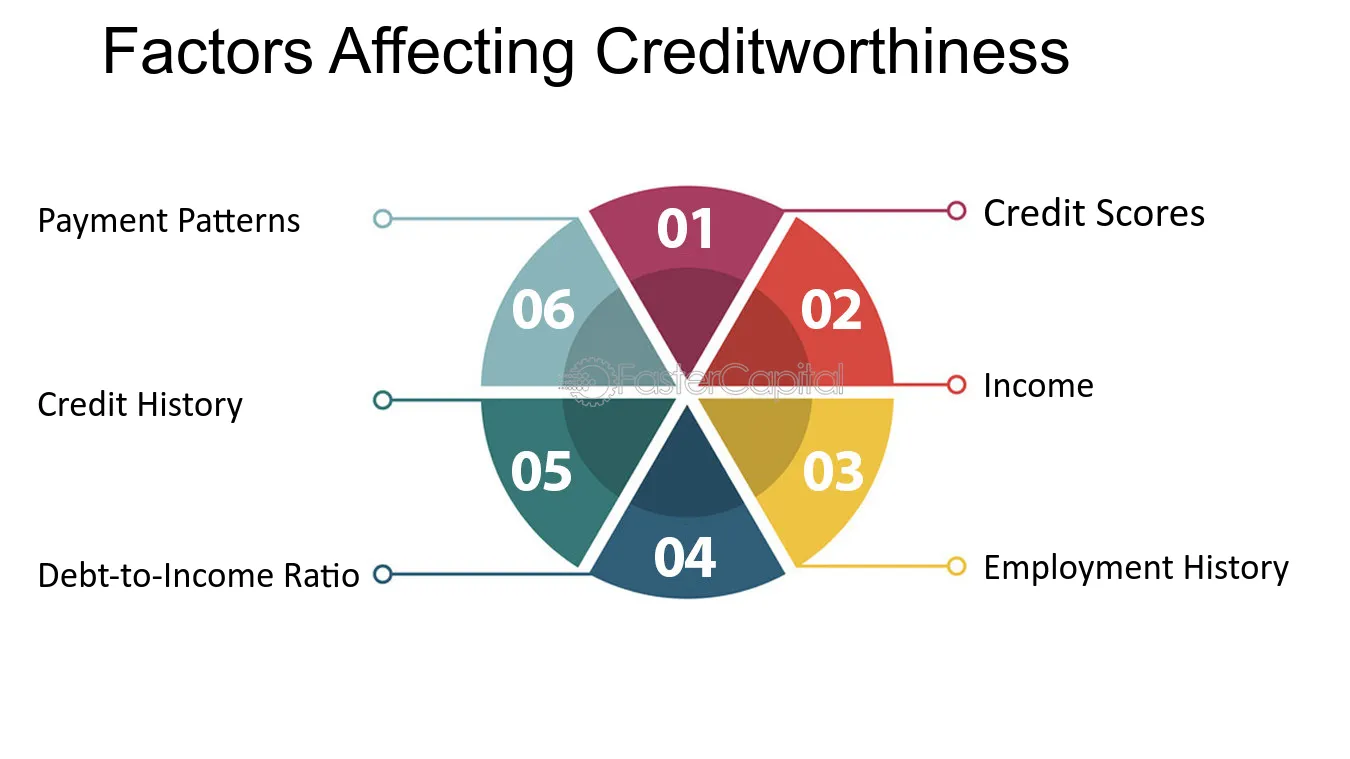

Factors Affecting Creditworthiness

Payment History

Subtitle: The Backbone of Creditworthiness A crucial aspect in assessing an individual’s creditworthiness is their payment history.

Lenders place a significant emphasis on how promptly borrowers meet their financial obligations. On-time payments are a testament to one’s responsible financial behavior and demonstrate reliability.

Consistently paying bills, loans, and credit card dues in a timely manner showcases a borrower’s ability to manage their finances effectively. On the flip side, late payments and defaults can have adverse consequences on one’s creditworthiness.

Late payments occur when borrowers fail to make their required payments within the specified due dates. This sends a concerning signal to lenders as it suggests potential financial instability or mismanagement of funds.

Defaults, which happen when a borrower fails to repay their debts altogether, carry even more severe implications for creditworthiness. They indicate a complete breakdown in financial responsibility and can lead to significant damage to an individual’s credit score.

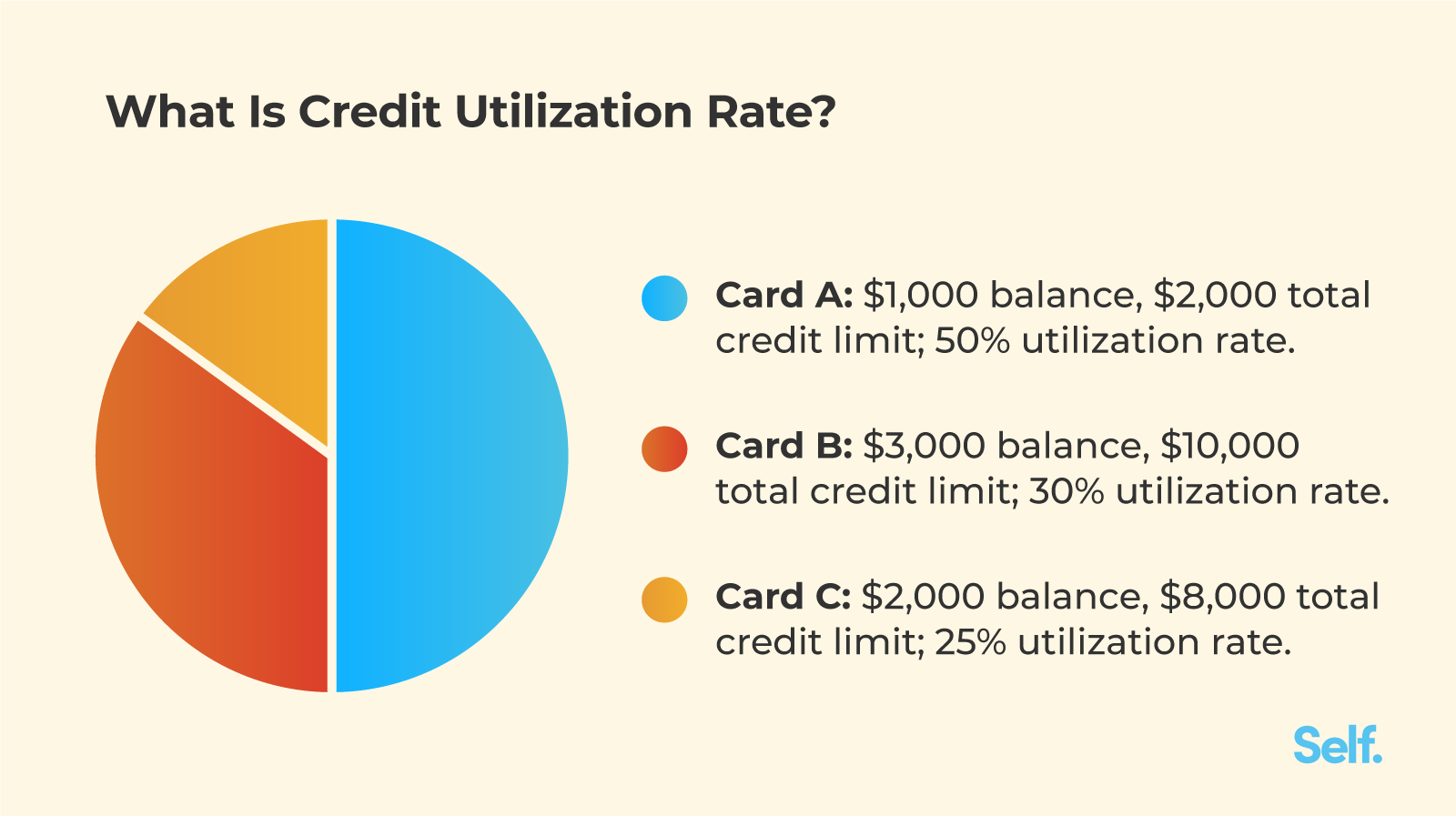

Credit Utilization Ratio

Subtitle: Balancing the Debt-Equity Scale Another critical factor influencing creditworthiness is the credit utilization ratio. This ratio measures the percentage of available credit that an individual utilizes at any given time.

Lenders closely scrutinize this metric as it provides insights into how responsibly borrowers handle their available credit limits. The calculation of the credit utilization ratio is relatively straightforward; it involves dividing the total outstanding balances by the total available credit limits across all accounts.

For example, if an individual has utilized $2,000 out of a total available limit of $10,000, their credit utilization ratio would be 20%. Maintaining a low credit utilization ratio (typically below 30%) is vital for maintaining good creditworthiness.

High ratios imply over-reliance on borrowed funds and may suggest potential financial strain or impulsive spending habits. Therefore, individuals should strive to pay down their debts and maintain a healthy balance between the credit they use and the credit available to them.

Length of Credit History

Subtitle: The Patina of Financial Maturity The length of one’s credit history plays a significant role in determining creditworthiness. Lenders prefer borrowers with longer credit histories as they provide a more substantial data set to assess financial behavior.

A more extended credit history allows lenders to observe patterns, trends, and consistency in an individual’s repayment behavior over time. A longer credit history is advantageous for several reasons.

Firstly, it provides lenders with more reliable information about a borrower’s financial habits and responsibility. It demonstrates that the individual has successfully navigated through different economic cycles while maintaining their repayment obligations.

Moreover, a lengthier credit history offers individuals an opportunity to build a strong credit profile gradually. By consistently making on-time payments and responsibly managing various types of accounts over an extended period, borrowers can establish themselves as reliable candidates for future borrowing needs.

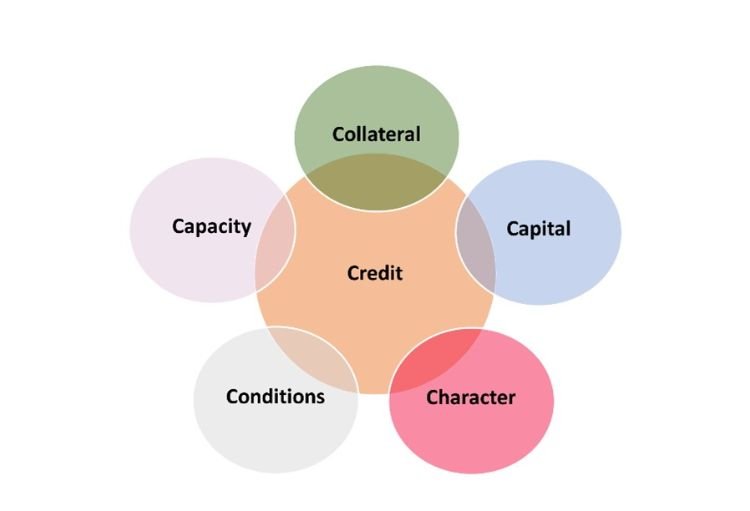

Types of Accounts and Mix of Credit

Subtitle: The Tapestry of Borrowing Experiences The types of accounts one holds and the mix of credit in their portfolio also play crucial roles in determining overall creditworthiness. Lenders appreciate borrowers who demonstrate experience managing diverse types of borrowing arrangements responsibly.

Revolving accounts, such as credit cards, allow individuals access to ongoing lines of credit with varying limits. Properly managing revolving accounts by making on-time payments and keeping balances low showcases discipline in handling short-term debt.

On the other hand, installment loans (e.g., mortgages or car loans) involve fixed payments over a predetermined period. Successfully managing installment loans indicates long-term financial commitment and stability.

A balanced mix of both revolving accounts and installment loans portrays versatility in handling different types of financial responsibilities. Demonstrating competence across these various borrowing instruments enhances one’s credibility as a borrower and contributes to a stronger creditworthiness profile.

The Role of Income and Employment in Assessing Creditworthiness

Stable Income Sources

When assessing creditworthiness, one crucial factor that lenders consider is the stability of the borrower’s income sources. Lenders want assurance that borrowers have a reliable and consistent stream of income to meet their financial obligations, including loan repayments.

Stable income sources typically include regular paychecks from full-time employment, stable self-employment income, or consistent rental property earnings. Lenders perceive individuals with stable income sources as less risky borrowers because they are more likely to have the financial capacity to make timely repayments.

Stable income provides a sense of financial security and demonstrates that the borrower can cover their expenses without relying on sporadic or unpredictable sources of funds. This stability is particularly important for long-term loans or large credit lines where lenders seek reassurance that borrowers will maintain a steady payment schedule throughout the loan term.

Importance for Lenders

The importance of stable income sources for lenders cannot be overstated. When lending money, lenders aim to minimize risks associated with defaults and delinquencies. By assessing a borrower’s income stability, lenders gain insights into their ability to meet financial obligations consistently over time.

Lending institutions understand that borrowers who lack stable incomes may struggle to make regular repayments or may default on their loans altogether. This puts both parties at risk, as late payments can lead to additional fees and interest charges while defaults result in significant financial losses for the lender.

Lenders also consider borrowers’ stable incomes when determining how much credit they are willing to extend. A higher level of confidence in a borrower’s earning potential allows lenders to offer larger loan amounts or more favorable terms since there is lower perceived risk associated with repayment.

Verification Process

Verifying an applicant’s stated income is an essential part of assessing creditworthiness accurately. Lenders employ various methods to verify income, ensuring that the information provided is accurate and reliable. One common verification method is requesting recent pay stubs or W-2 forms to confirm employment status and income levels.

Lenders may also contact employers directly to verify employment details such as job title, length of employment, and salary. Self-employed individuals may need to provide tax returns or profit and loss statements to establish their income credibility.

Lenders may also request permission from borrowers to access their bank statements, allowing them to verify regular deposits consistent with the claimed income levels. This process helps lenders ensure that borrowers are not inflating their incomes or relying solely on irregular sources of funds.

By conducting a thorough verification process, lenders can make informed decisions about an applicant’s creditworthiness based on accurate and validated income information. This process protects both the lender’s interests and the borrower’s financial well-being by aligning loan terms with the borrower’s realistic repayment capacity.

Employment History

In addition to stable income sources, a borrower’s employment history plays a vital role in establishing creditworthiness. Employment history provides valuable insights into an individual’s past financial stability and reliability in meeting obligations.

Lenders typically prefer borrowers who demonstrate a consistent work record with minimal gaps in employment. A solid employment history indicates job stability and reliability in generating income over time.

It signifies that the individual has been able to maintain steady employment, indicating potentially lower risks of future income disruptions. Furthermore, long-term employment with the same employer can contribute positively to creditworthiness assessments.

Longevity with one employer showcases commitment, loyalty, and professional growth potential—all factors that lenders consider when evaluating an applicant’s likelihood of maintaining stable income streams for repayment purposes. Job Stability as a Factor

Job stability operates hand-in-hand with employment history when assessing creditworthiness. Lenders assess factors such as job changes frequency, periods of unemployment between jobs if any exist, and the overall stability of the borrower’s career path.

Frequent job changes can raise concerns for lenders, as they may indicate instability or lack of commitment. On the other hand, steady employment with minimal job changes demonstrates a higher level of reliability and reduces concerns over income disruptions that could hinder loan repayments.

Job stability is also crucial in scenarios where borrowers are applying for long-term loans such as mortgages. Lenders prefer borrowers who have a secure footing in their careers, as this provides confidence that they will consistently generate income to meet mortgage obligations over an extended period.

By evaluating both employment history and job stability, lenders gain valuable insights into a borrower’s financial responsibility and capacity to meet credit obligations consistently. A strong employment background coupled with stable job tenure enhances creditworthiness by showcasing stability and reducing perceived risks for lenders.

Credit Reports and Scores

Credit Reporting Agencies (CRAs)

Credit reporting agencies (CRAs) play a pivotal role in the assessment of creditworthiness. These agencies are responsible for collecting, maintaining, and providing consumer credit information to lenders, businesses, and individuals who have a legitimate need for it.

The three major CRAs that dominate the industry are Equifax, Experian, and TransUnion. These agencies act as repositories of financial data and compile comprehensive credit reports that summarize an individual’s credit history.

Explanation of Major CRAs (e.g., Equifax, Experian, TransUnion)

Equifax: Equifax is one of the oldest and most widely recognized CRAs. It collects information from various sources such as creditors, lenders, public records, and other relevant entities to build detailed credit reports.

Their extensive database enables them to provide comprehensive insights into an individual’s financial habits. Experian: Experian is another leading CRA known for its vast consumer database.

It gathers data on credit card usage, loan payments, bankruptcies, public records related to financial matters such as tax liens or judgments. Furthermore, Experian offers additional services like identity theft protection and monitoring.

TransUnion: TransUnion stands as a reputable CRA that focuses on gathering accurate credit information from different sources. They specialize in compiling data related to late payments or defaults on loans or debts.

Role in Collecting Consumer Data

The primary function of these CRAs is to collect consumer data accurately while ensuring its privacy and security. They obtain information from various sources like banks, lenders, collection agencies – essentially any entity with which an individual has had a financial relationship.

CRAs collect data points such as payment history (including late payments or defaults), types of accounts held (credit cards vs. installment loans), outstanding balances, and credit limits.

They also include public records like bankruptcies, tax liens, or court judgments. By aggregating this information into credit reports, CRAs offer a comprehensive overview of an individual’s financial behavior and creditworthiness.

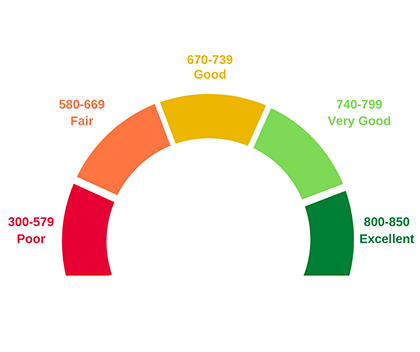

Credit Scores

Credit scores are numerical representations of an individual’s creditworthiness and are derived from the information contained in their credit reports. Lenders utilize these scores to assess the risk involved in extending credit to a borrower. The most commonly used scoring model is the FICO score (developed by the Fair Isaac Corporation), which ranges from 300 to 850.

Definition and Calculation Methods

A credit score represents a borrower’s likelihood of repaying their debts on time based on historical data. It takes into account various factors such as payment history, length of credit history, types of accounts held, and amounts owed. Credit scoring models employ complex algorithms that weigh each factor differently to calculate a final score.

For example, payment history carries significant weight as it signifies an individual’s ability to meet financial obligations promptly. Similarly, types of accounts held impact the overall score as having a mix of revolving accounts (like credit cards) and installment loans demonstrates responsible borrowing behavior.

Significance for Lenders

Credit scores hold immense significance for lenders as they serve as a reliable indicator in evaluating potential borrowers’ trustworthiness. A high credit score suggests responsible financial management and increases the likelihood of loan approvals with favorable terms such as lower interest rates or higher borrowing limits. Lenders rely on these scores to make informed decisions regarding lending money or extending lines of credit.

A low score may result in fewer borrowing options or higher interest rates due to perceived risk associated with repayment. Credit Reporting Agencies such as Equifax, Experian, and TransUnion play pivotal roles in collecting accurate consumer data and compiling comprehensive credit reports.

The credit reports, in turn, form the basis for calculating credit scores, which lenders utilize to assess the creditworthiness of potential borrowers. Understanding the significance of these agencies and how they contribute to the overall evaluation of individuals’ creditworthiness is crucial in navigating the world of finance and securing favorable financial opportunities.

Importance of Maintaining Good Creditworthiness

Access to Better Financial Opportunities

Maintaining good creditworthiness plays a pivotal role in accessing a myriad of financial opportunities. Lenders and financial institutions consider creditworthiness as a key factor in determining an individual’s eligibility for loans, credit cards, and other forms of credit.

When you have a strong credit profile, doors open to various financial opportunities that may not be available to those with poor creditworthiness. These opportunities include obtaining higher loan amounts, securing lower interest rates, and gaining access to premium credit cards with attractive rewards programs.

Lower Interest Rates on Loans

One of the significant advantages of maintaining good creditworthiness is the ability to secure loans at lower interest rates. Lenders perceive individuals with stellar credit scores and positive payment history as low-risk borrowers who are more likely to repay their debts on time. As a result, they are willing to offer them loans at more favorable terms.

With lower interest rates, borrowers can save substantial amounts of money over the life of their loans. Whether it’s a mortgage, car loan, or personal loan, having good creditworthiness can potentially lead to significant savings by reducing the overall cost of borrowing.

Higher Chance of Approval for Credit Applications

Maintaining good creditworthiness greatly increases your chances of having your applications approved when seeking new lines of credit or financial products. When lenders evaluate applications from individuals with favorable credit profiles, they are more inclined to grant approval due to their demonstrated responsible borrowing behavior and low default risk. This means that individuals with strong creditworthiness have an advantage in obtaining new lines of credits such as mortgage refinancing or securing high-value loans for major purchases like homes or vehicles.

Conclusion

In today’s world where access to financial resources plays a crucial role in achieving personal and financial goals, maintaining good creditworthiness is paramount. By diligently managing your finances, making timely payments, and keeping your credit utilization ratios low, you can improve your creditworthiness and open doors to a multitude of better financial opportunities.

From lower interest rates on loans to higher chances of credit approval, the benefits of a strong credit profile are numerous. So take charge of your financial well-being, build and maintain good creditworthiness – a gateway to a brighter future.