Quick Finance

Finance plays an indispensable role in our lives, and the ability to access funds quickly has become increasingly vital in today’s fast-paced society. Quick finance, as the name suggests, refers to financial solutions that are readily available and accessible within a short span of time. Whether it is meeting unexpected expenses, seizing an investment opportunity, or fulfilling urgent business needs, quick finance provides individuals and businesses with the means to bridge their financial gaps swiftly.

Definition of Quick Finance

Quick finance encompasses a range of financial products and services that are designed to offer prompt access to funds. It primarily caters to situations where individuals or businesses require immediate cash infusion without going through lengthy approval processes typical of traditional loans. From personal loans and credit cards to short-term business financing options like merchant cash advances and invoice factoring, quick finance provides expedited funding solutions for diverse monetary needs.

The Importance of Quick Finance in Modern Society

In today’s fast-paced world where time is a precious commodity, quick finance has emerged as an essential tool for individuals and businesses alike. The importance of quick finance lies in its ability to provide timely relief during unforeseen circumstances or when opportunities arise that demand immediate capital injection. For instance, it allows individuals to address emergency medical expenses promptly or seize limited-time offers on essential purchases without delay.

In the business realm, quick finance ensures smooth operations by enabling entrepreneurs to meet urgent working capital requirements, pay suppliers on time, or invest in growth opportunities as they arise. In the dynamic landscape of modern commerce marked by rapid changes and fierce competition, being able to access funds swiftly can make all the difference between success and stagnation.

Furthermore, quick finance plays a crucial role in fostering entrepreneurship by reducing barriers for aspiring business owners who lack substantial personal capital. It empowers them to turn their ideas into reality, contributing to economic growth and job creation.

Overview of Quick Finance

Definition and Scope of Quick Finance

Quick finance refers to the provision of immediate funds or financial assistance to individuals or businesses in need. It encompasses a range of financial products and services designed to address urgent monetary requirements, such as unexpected expenses, emergencies, or short-term liquidity needs.

The primary objective of quick finance is to provide swift access to capital, enabling borrowers to meet their financial obligations without delay. The scope of quick finance extends beyond traditional lending methods, incorporating various alternative options that have emerged with advancements in technology and changes in consumer behavior.

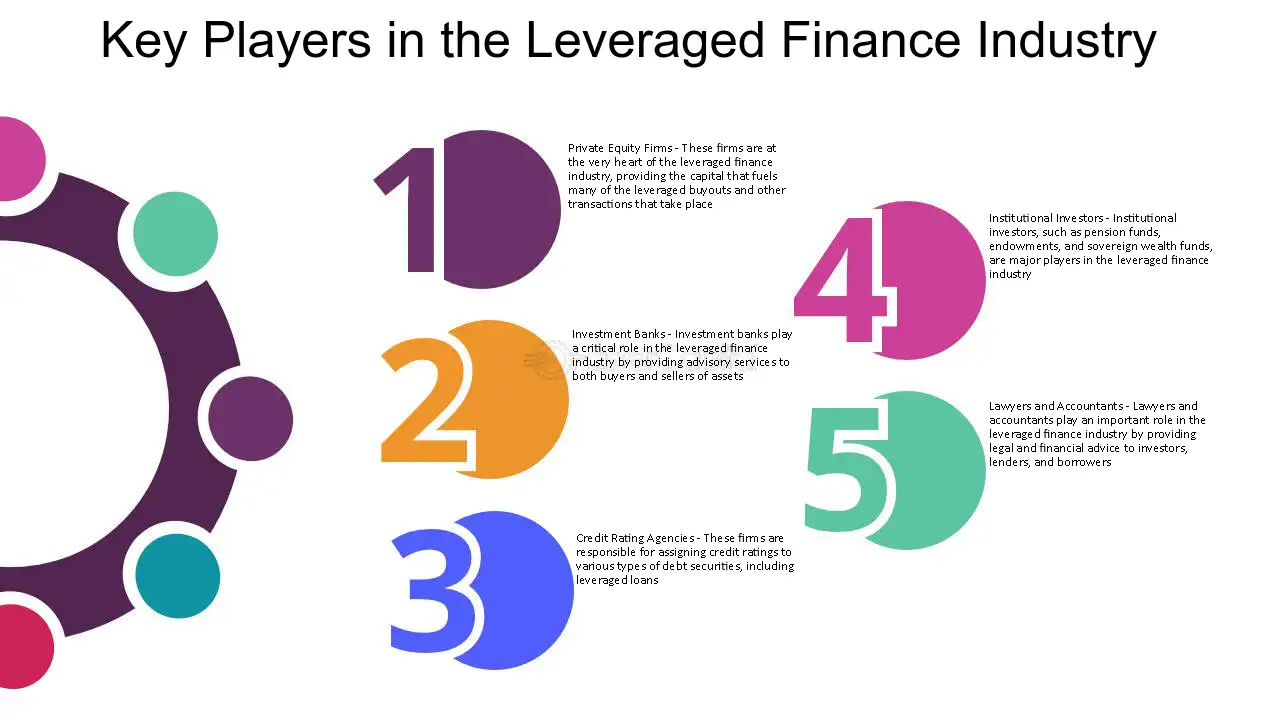

Key Players in the Quick Finance Industry

The quick finance industry comprises a diverse ecosystem supported by several key players. These entities play pivotal roles in facilitating efficient and expedited access to funds for individuals and businesses alike. Banks and Financial Institutions: Traditional banks remain significant players in the quick finance landscape.

They offer a wide range of loan products tailored for immediate financing needs, including personal loans, credit cards, lines of credit, and small business loans. Banks generally provide these services through brick-and-mortar branches as well as online platforms.

Online Lenders: Online lenders have become increasingly prominent within the quick finance sector due to their ability to leverage digital technology for streamlined processes and faster loan approvals. These non-bank lenders often focus on specific niches such as personal loans or small business financing, providing borrowers with flexible options outside traditional banking channels.

Fintech Companies: The rise of financial technology (fintech) has brought forth innovative players that combine technology-driven solutions with financial services. Fintech companies often specialize in developing digital platforms or mobile apps that facilitate quick access to loans or credit facilities.

They utilize advanced algorithms for assessing creditworthiness swiftly while offering personalized loan terms based on individual circumstances. These key players collectively contribute to the evolving landscape of quick finance, offering borrowers a diverse range of options to meet their immediate financial needs efficiently.

Types of Quick Finance Options

Personal Loans

When it comes to quick financing options, personal loans offer a versatile solution for individuals in need of immediate funds. Unsecured personal loans provide borrowers with the freedom to access funds without having to provide collateral.

These loans are typically based on the borrower’s creditworthiness and income, enabling quicker approval processes and disbursement of funds. On the other hand, payday loans and cash advances are short-term loans that are often repaid with the borrower’s next paycheck.

While they can be obtained swiftly, they often come with higher interest rates and fees due to their convenience factor. Peer-to-peer lending platforms have emerged as an alternative option where individuals can borrow directly from individual investors through online platforms.

Credit Cards and Lines of Credit

Credit cards serve as a popular means of quick finance due to their widespread availability and convenience. They allow users to make purchases or withdraw cash up to a certain credit limit set by the issuer. Credit cards offer benefits such as reward programs and fraud protection but can also lead individuals into debt if not used responsibly.

On the other hand, lines of credit offer a flexible financing option that enables borrowers to access funds up to a predetermined limit whenever needed. These lines work similarly to credit cards but often carry lower interest rates.

Short-term Business Financing

For businesses seeking rapid financial assistance, several short-term financing options exist beyond traditional bank loans. Merchant cash advances allow businesses to receive upfront capital in exchange for future sales revenue or receivables. This type of financing is particularly suitable for businesses with consistent credit card sales volume but may come with higher fees compared to other options.

Invoice factoring offers an avenue where companies sell their accounts receivable at a discounted rate in exchange for immediate cash flow, assisting in managing working capital fluctuations effectively. Additionally, equipment leasing allows businesses to acquire necessary machinery or equipment without substantial upfront costs, offering flexibility as requirements may change over time.

Advantages and Disadvantages of Quick Finance

Advantages:

Quick finance options come with several advantages that make them appealing to individuals seeking immediate funds. Firstly, these options provide speedy access to funds, ensuring urgent financial needs can be met promptly.

Moreover, the application process is often convenient and user-friendly, with many lenders now offering online platforms for easy accessibility. Additionally, quick finance options offer flexibility in terms of loan amounts, repayment terms, and eligibility criteria compared to traditional loans.

Disadvantages:

It’s essential to consider the potential drawbacks associated with quick finance options. One notable disadvantage is that these options generally come with higher interest rates compared to traditional loans.

Borrowers must exercise caution and carefully assess their ability to handle the increased financial burden arising from these higher rates. There is also a risk of falling victim to predatory lending practices prevalent in the quick finance industry.

It is crucial for borrowers to thoroughly research lenders and understand all terms and conditions before committing to any loan agreement. Furthermore, individuals with poor credit scores may face limited borrowing capacity or be subject to even higher interest rates due to their perceived risk by lenders.

Factors to Consider Before Opting

Assessing the urgency of financial need

Prioritizing financial needs based on urgency is crucial before opting for quick finance solutions. This helps determine whether alternative methods such as savings or budget adjustments could suffice instead of taking on additional debt.

Evaluating interest rates, fees, and repayment terms

Before proceeding with any quick financing option, it’s essential for borrowers to carefully evaluate the associated interest rates charged by lenders as well as any additional fees involved in the borrowing process. Understanding the repayment terms, including any penalties for late payments, is also crucial to avoid any surprises down the line.

Understanding the impact on credit score

Borrowers should consider how quick finance options may impact their credit score. Timely repayments can positively affect creditworthiness, while defaulting or late payments may have adverse effects. It’s important to consider this aspect before making any financing decisions.

Tips for Responsible Use Options

Borrow only what you need

It is vital to be cautious when borrowing and only take what is necessary to meet immediate financial obligations. Avoid the temptation of borrowing more than required, as it could lead to unnecessary debt burdens.

Conclusion

In the fast-paced world we live in, quick finance options serve as a valuable resource for individuals and businesses facing urgent financial needs. While these options offer speedy access to funds and convenient application processes, caution must be exercised due to higher interest rates and potential predatory lending practices.

By assessing urgency, evaluating terms, considering credit impacts, and using these options responsibly, individuals can navigate quick finance solutions effectively while safeguarding their financial well-being. Remember that responsible usage of quick finance can provide a lifeline during times of need while maintaining financial stability in the long run.