Affordable credit

Access to affordable credit is a fundamental aspect of modern society, playing a pivotal role in enabling individuals and businesses to pursue their goals and aspirations. In essence, affordable credit refers to the availability of loans and financial resources at reasonable terms that do not impose an excessive burden on borrowers. It encompasses both the interest rates charged on loans and the overall cost of borrowing, taking into account factors such as fees, repayment periods, and other associated charges.

A Gateway to Financial Stability

Affordable credit serves as a gateway to financial stability for individuals from all walks of life. Whether it’s purchasing a home or car, financing education or business ventures, or simply managing unexpected expenses, access to reliable and affordable credit allows individuals to improve their quality of life and seize opportunities that might otherwise be out of reach.

Fueling Economic Growth

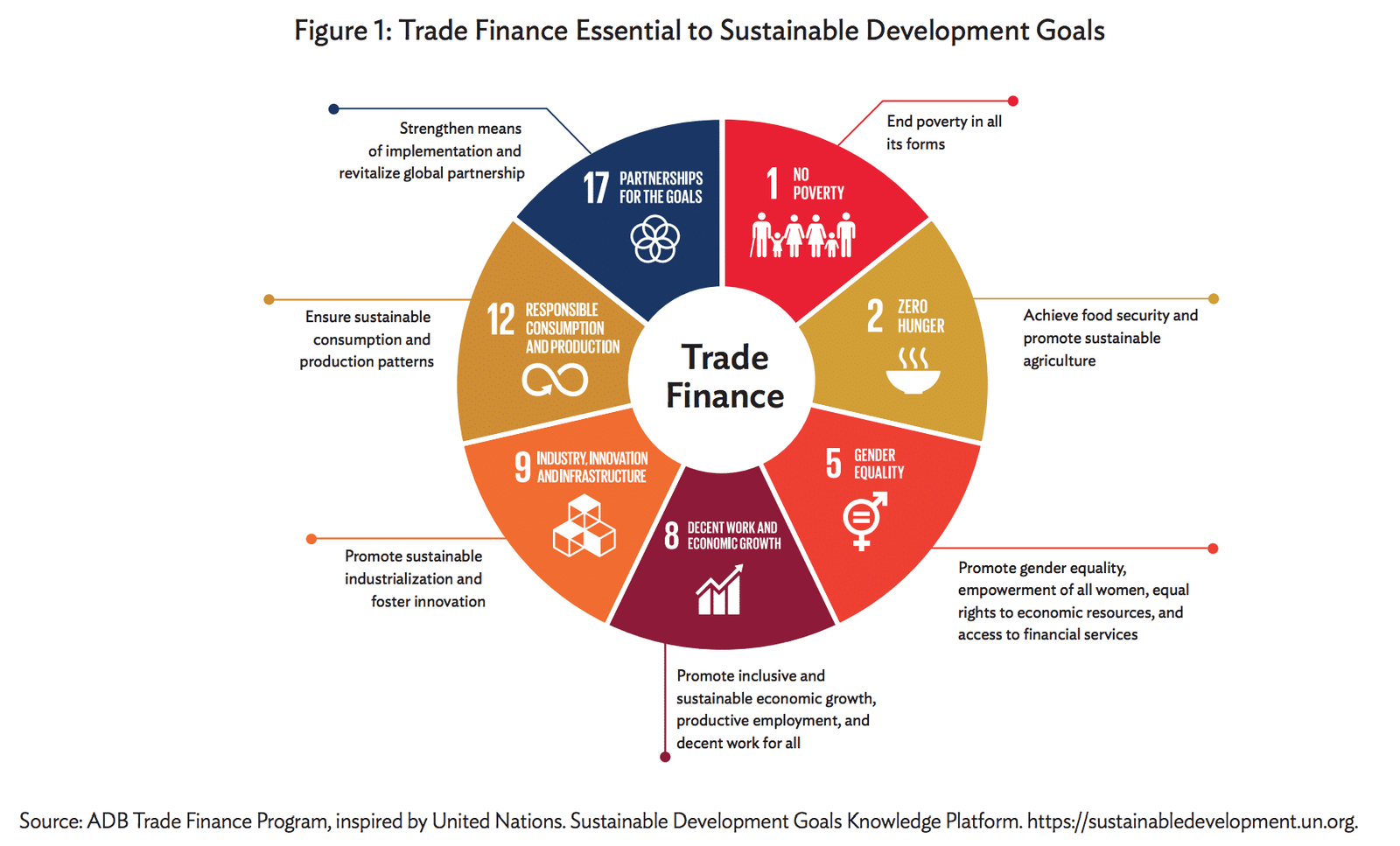

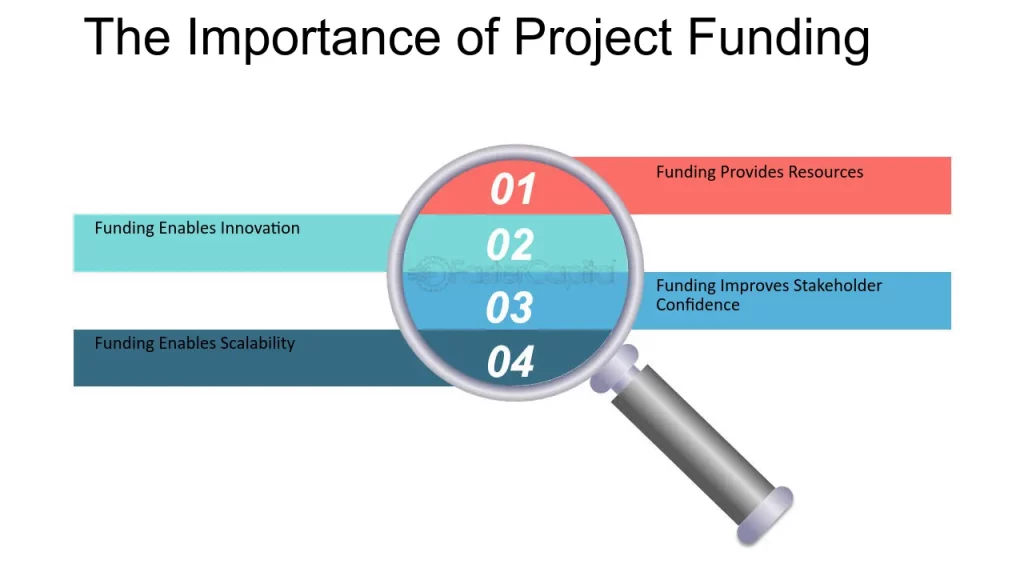

The importance of affordable credit extends beyond individual needs; it is also instrumental in driving economic growth at both micro- and macro-levels. When businesses can access affordable credit easily, they can invest in expansions, purchase necessary equipment or inventory, hire more employees – all contributing to increased productivity. This ripple effect stimulates job creation, increases consumer spending power, and fosters innovation – ultimately propelling the economy forward.

A Tool for Financial Inclusion

Moreover, affordable credit plays a vital role in promoting financial inclusion by addressing inequalities stemming from socioeconomic disparities. Historically marginalized populations often face hurdles in accessing traditional banking services due to limited assets or insufficient credit history. Affordable credit options tailored towards these underserved communities provide avenues for economic empowerment by allowing them to build assets over time while improving their financial standing through responsible borrowing.

Balancing Access with Responsible Lending

While it is essential for lenders to make credit accessible, responsible lending practices are equally crucial. Balancing access with borrower protection ensures that individuals are not burdened with unmanageable debt or trapped in cycles of financial distress.

Striking this balance requires regulatory frameworks that safeguard against predatory lending practices, while also encouraging financial institutions to offer affordable credit products. In the following sections, we will delve into the intricacies of credit affordability, exploring the factors that influence it and examining various initiatives aimed at expanding access to affordable credit.

We will also highlight the pivotal role played by alternative lenders and fintech solutions in bridging gaps in traditional banking services. Additionally, we will shed light on the significance of financial education in empowering individuals to make informed decisions about credit usage.

Understanding Credit

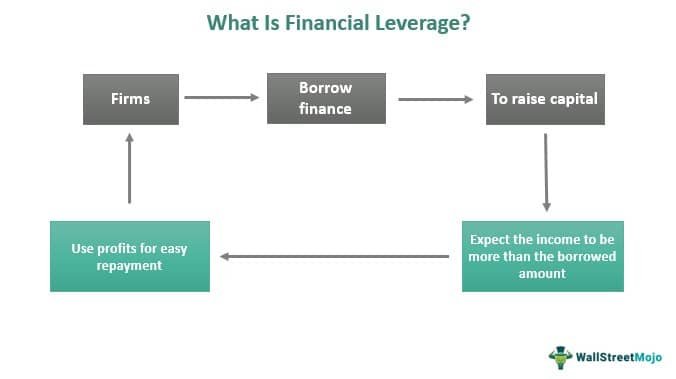

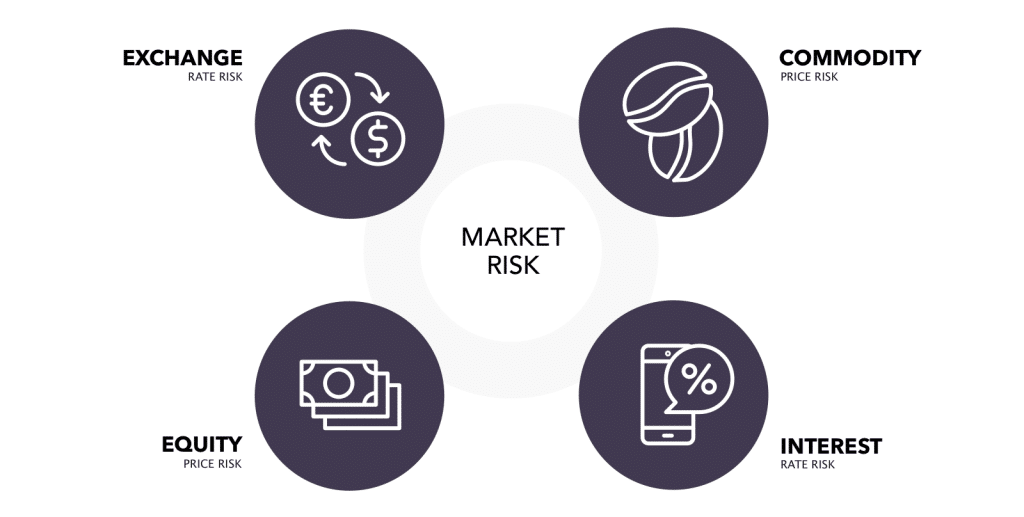

Explanation of credit and its role in the economy

Credit is a financial instrument that allows individuals, businesses, and governments to borrow money with the promise of repayment in the future. It plays a pivotal role in driving economic growth and facilitating transactions across various sectors.

Credit enables consumers to make large purchases such as homes or vehicles by providing immediate access to funds that they may not have on hand. It also empowers businesses to invest in expansion, research, and development, which ultimately fuels innovation and job creation.

Furthermore, credit allows governments to fund public projects like infrastructure development or social programs. In essence, credit acts as a catalyst for economic activity by providing liquidity and stimulating spending.

Different types of credit available to consumers

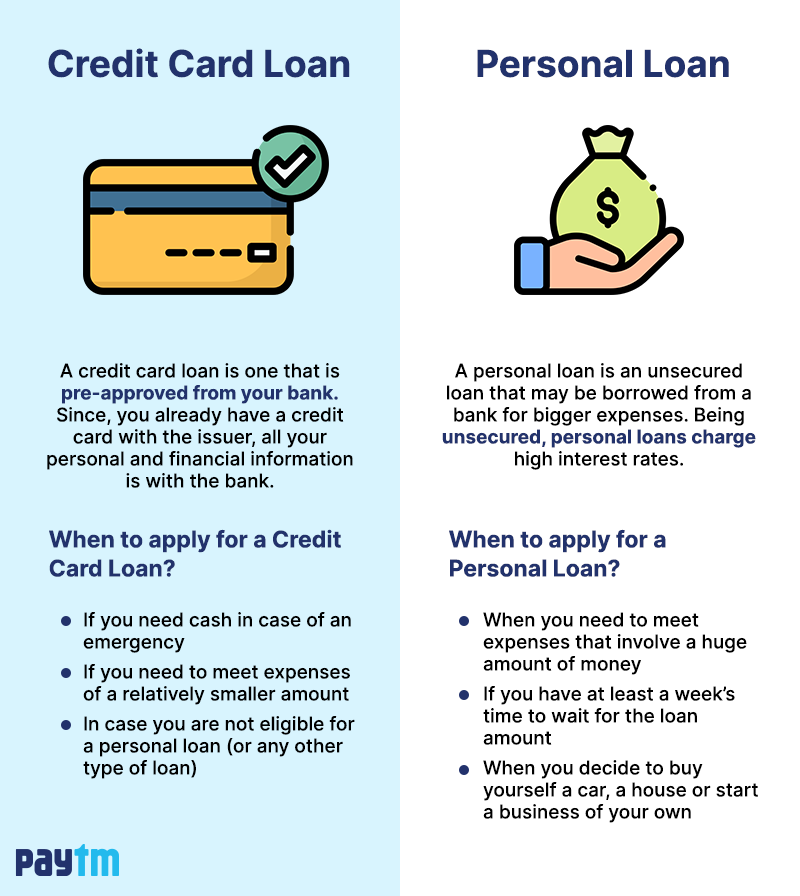

Consumers have access to several types of credit depending on their needs and financial circumstances. The most common forms include installment loans, revolving credit lines (such as credit cards), mortgages, and personal loans.

Installment loans are typically issued for specific purposes (e.g., auto loans or student loans) with fixed repayment terms over a predetermined period. Revolving credit lines offer flexibility since borrowers can borrow up to a certain limit repeatedly while making minimum monthly payments; this form of credit is commonly associated with credit cards.

Mortgages enable individuals to finance the purchase of homes by securing loans against the property itself as collateral. Personal loans provide funds for various personal expenses ranging from medical bills to home renovations without requiring any specific collateral.

Factors Influencing Credit Affordability

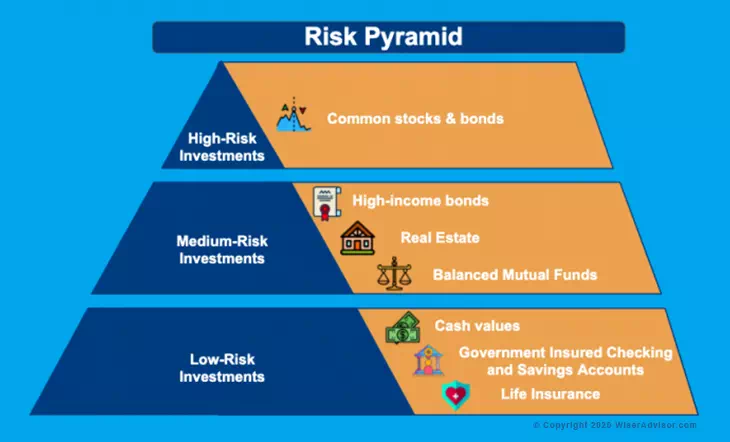

When it comes to accessing credit, several factors play a crucial role in determining its affordability. Two primary factors that significantly impact the cost of borrowing are interest rates and APRs (Annual Percentage Rates).

Interest rates, expressed as a percentage of the principal amount, represent the cost of borrowing money. The higher the interest rate, the more expensive the credit becomes for borrowers.

How interest rates affect the affordability of credit

The level of interest rates directly affects borrowers’ monthly payments and their ability to repay loans comfortably. When interest rates rise, so do monthly payments on existing loans and new borrowings.

This increase in payments can strain individuals’ budgets and make it difficult for them to afford additional credit or manage their existing debt load effectively. High-interest rates not only limit individuals’ access to affordable credit but also perpetuate a cycle of debt that can have long-term financial consequences.

The impact of APR on overall cost of borrowing

Another vital component in understanding credit affordability is the Annual Percentage Rate (APR). While interest rates represent only a portion of the total cost of borrowing, APR encompasses all fees associated with obtaining credit.

This includes origination fees, closing costs, and any other charges imposed by lenders. The APR provides a more accurate picture of how much borrowing will truly cost over time.

For example, let’s consider two loan offers: one with a low-interest rate but high upfront fees and another with a slightly higher interest rate but no additional charges. While the first loan may seem more affordable initially due to its lower interest rate alone, evaluating both offers based on their respective APRs reveals which option is truly cheaper in terms of overall cost.

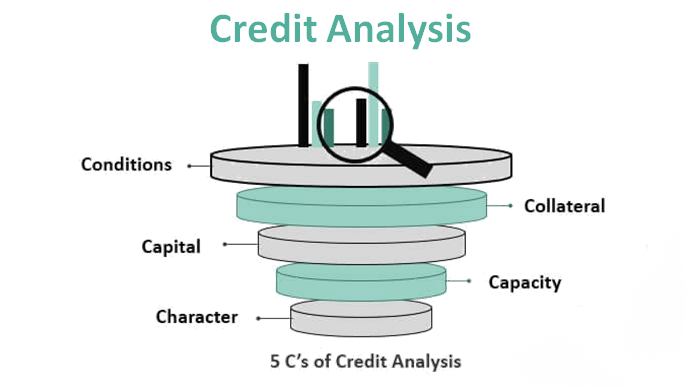

Credit scores and their significance in accessing affordable credit

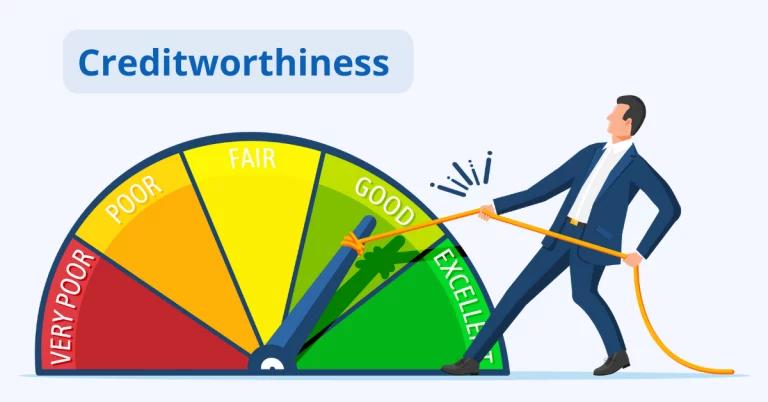

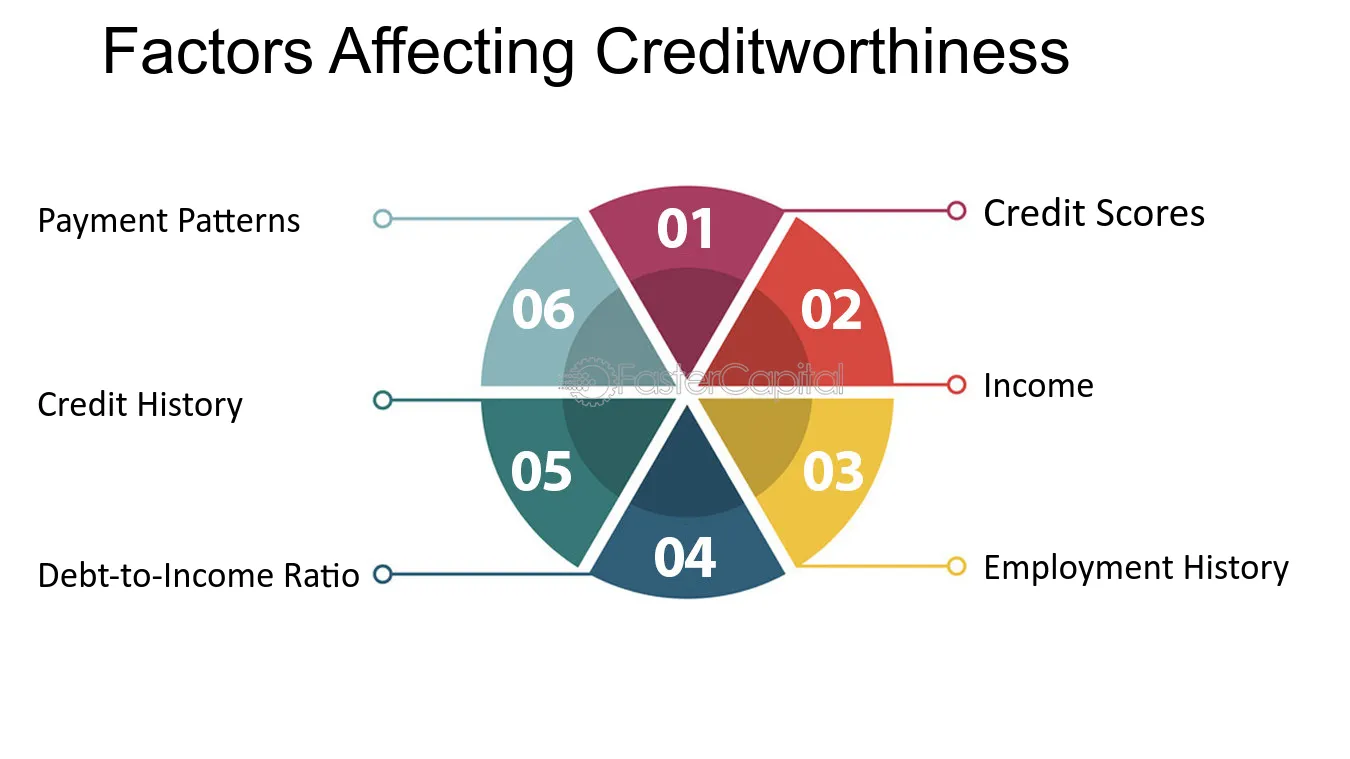

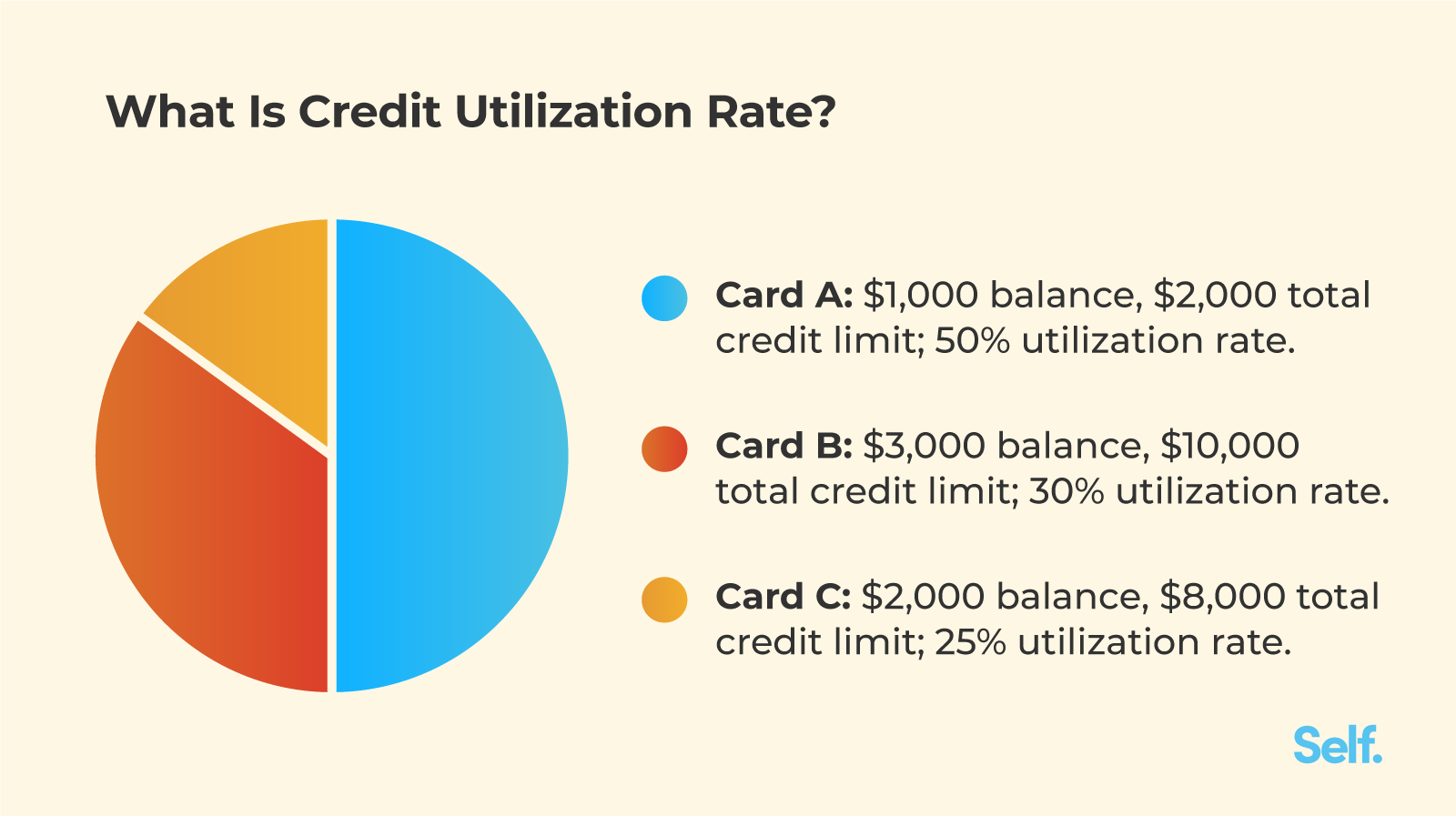

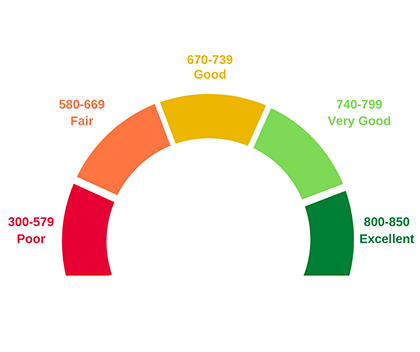

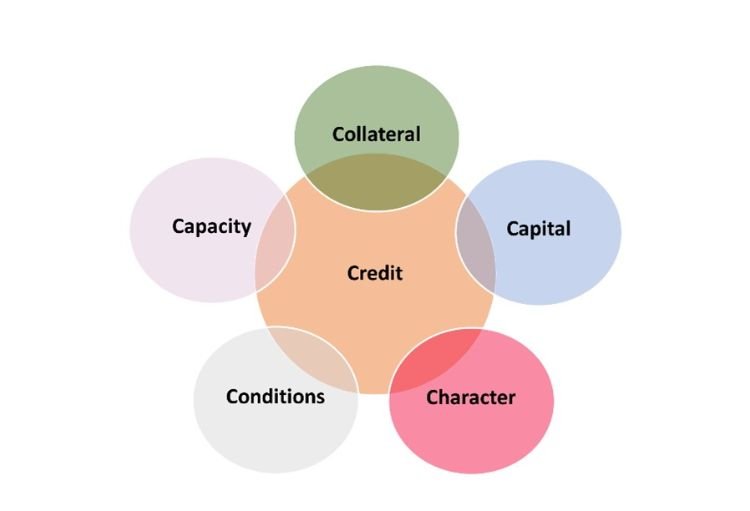

When it comes to accessing affordable credit, credit scores play a crucial role. Lenders utilize credit scoring models, such as FICO and VantageScore, to assess borrowers’ creditworthiness and determine the risk level associated with lending them money. These models consider various factors, including payment history, credit utilization ratio, length of credit history, types of credit used, and new credit inquiries.

A higher credit score indicates a lower risk for lenders and opens the door to more affordable borrowing options. Individuals with excellent credit scores are likely to enjoy lower interest rates and better loan terms compared to those with poor or average scores.

It is essential for individuals seeking affordable credit to understand how their financial behavior impacts their credit scores and take proactive steps towards improving them. This can be achieved by paying bills on time, maintaining low balances on existing lines of credit, avoiding excessive amounts of debt, and regularly monitoring their credit reports for errors or discrepancies.

The Role of Government Initiatives in Promoting Affordable Credit

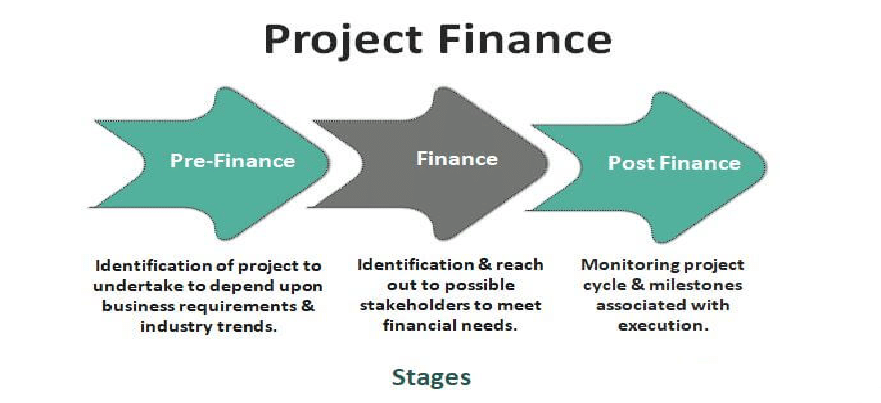

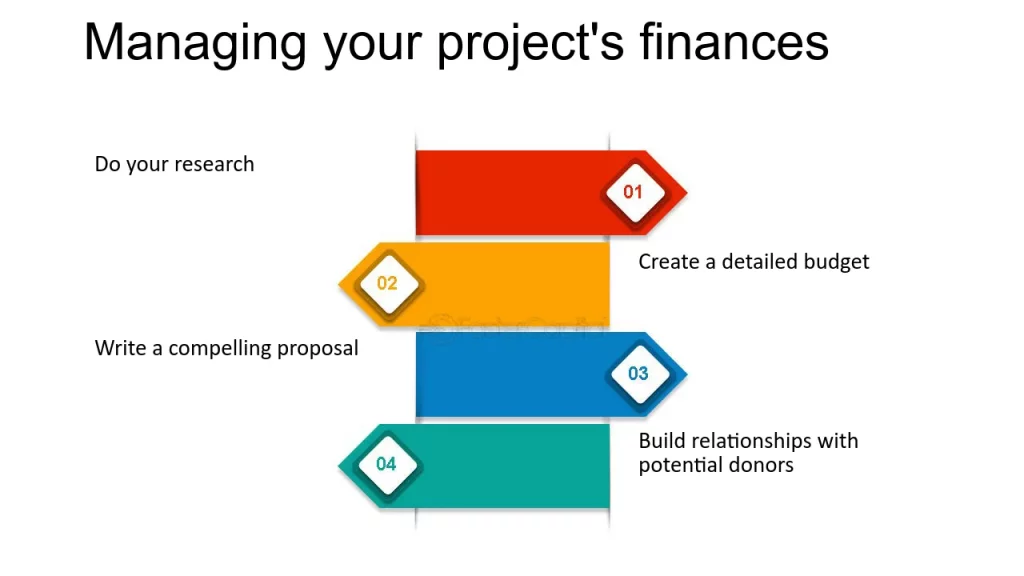

Overview of government programs aimed at increasing access to affordable credit for low-income individuals and small businesses

Government initiatives play a crucial role in promoting affordable credit, particularly for those who are economically disadvantaged. Two prominent programs striving to increase access to affordable credit are the Community Reinvestment Act (CRA) and the Small Business Administration (SBA) loan programs.

The Community Reinvestment Act, enacted in 1977, requires banks to meet the credit needs of their community, especially low- and moderate-income individuals and neighborhoods. It encourages banks to provide fair and non-discriminatory lending practices, offering loans with reasonable terms and conditions.

On the other hand, the Small Business Administration provides various loan programs aimed at assisting small businesses that may face difficulties accessing traditional sources of credit. These programs provide guarantees on loans made by participating lenders, reducing risk and encouraging lending to small businesses.

Analysis of the effectiveness and limitations of these initiatives

The effectiveness of government initiatives promoting affordable credit can be assessed through various measures. For instance, examining the extent to which these programs have increased access to credit for low-income individuals is crucial.

Studies have shown that the CRA has had a tangible impact on increasing mortgage lending in previously underserved communities. Additionally, SBA loan programs have facilitated economic growth by providing financing opportunities for small businesses that may not meet conventional lending criteria.

However, it is important to acknowledge that both initiatives also face limitations. The CRA’s effectiveness can vary depending on how rigorously it is enforced by regulatory bodies overseeing compliance with its provisions.

Similarly, SBA loan programs may encounter challenges related to administrative processes or insufficient funding allocations. Overall, while government initiatives like the CRA and SBA loan programs have made significant strides towards enhancing access to affordable credit for low-income individuals and small businesses alike, continuous evaluation, and potential improvements are necessary to ensure their long-term viability and effectiveness.

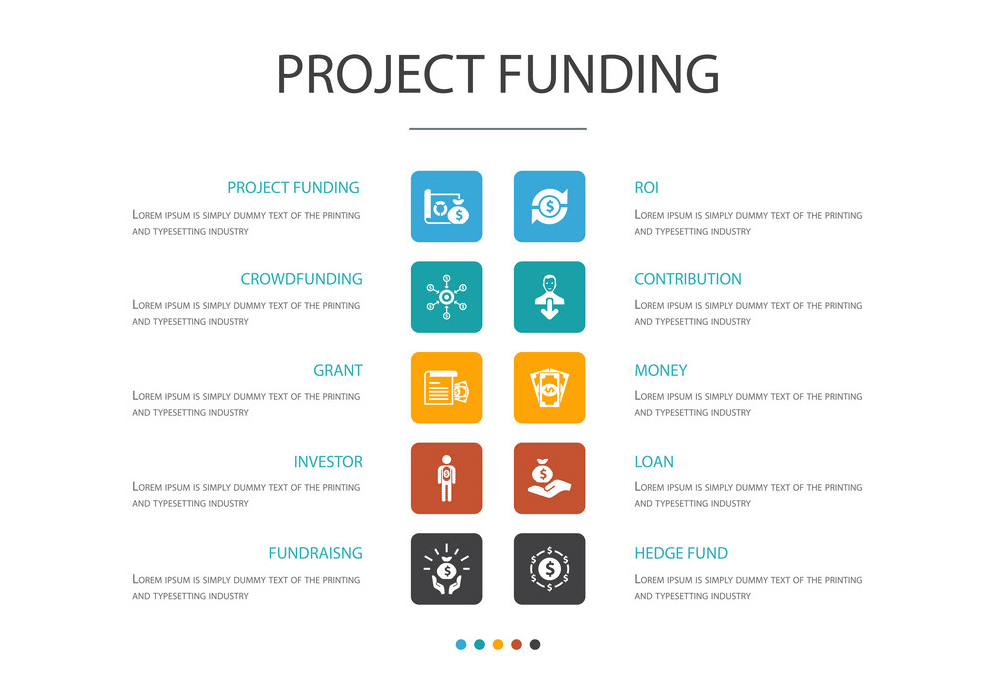

Alternative Lenders and Fintech Solutions for Affordable Credit

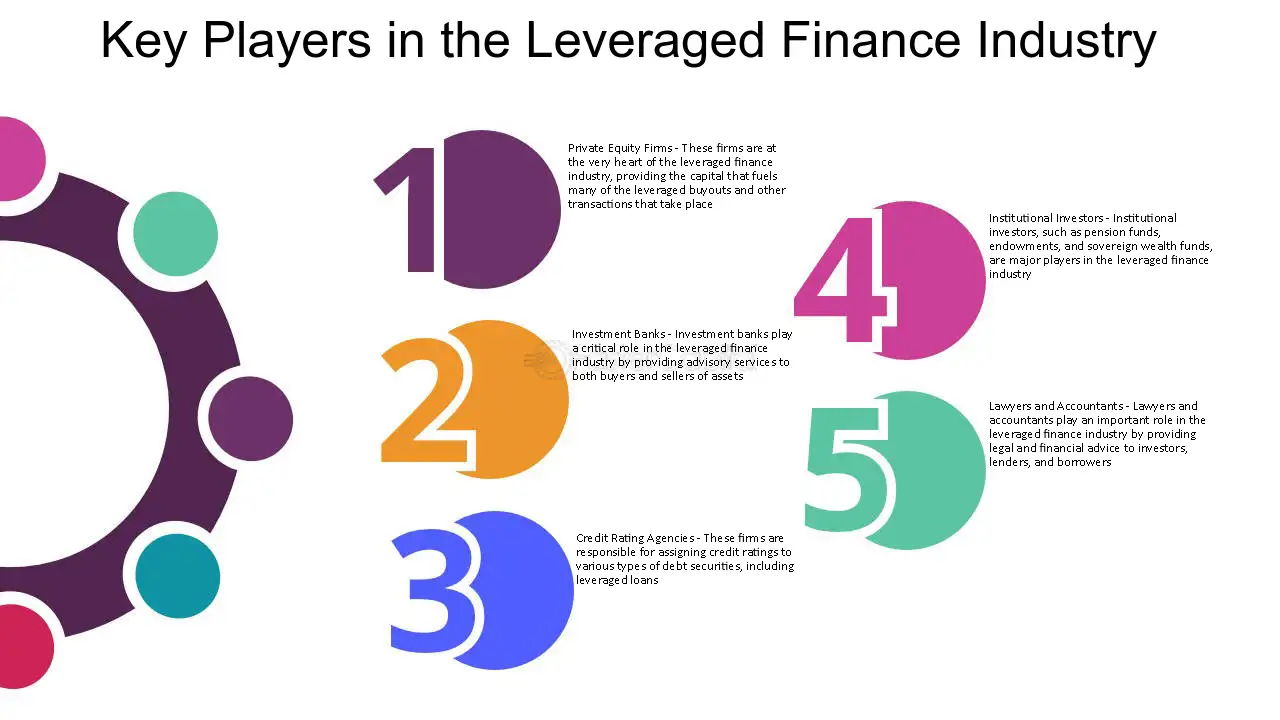

Introduction to Alternative Lenders and Their Role in Providing Affordable Credit Options Outside Traditional Banks

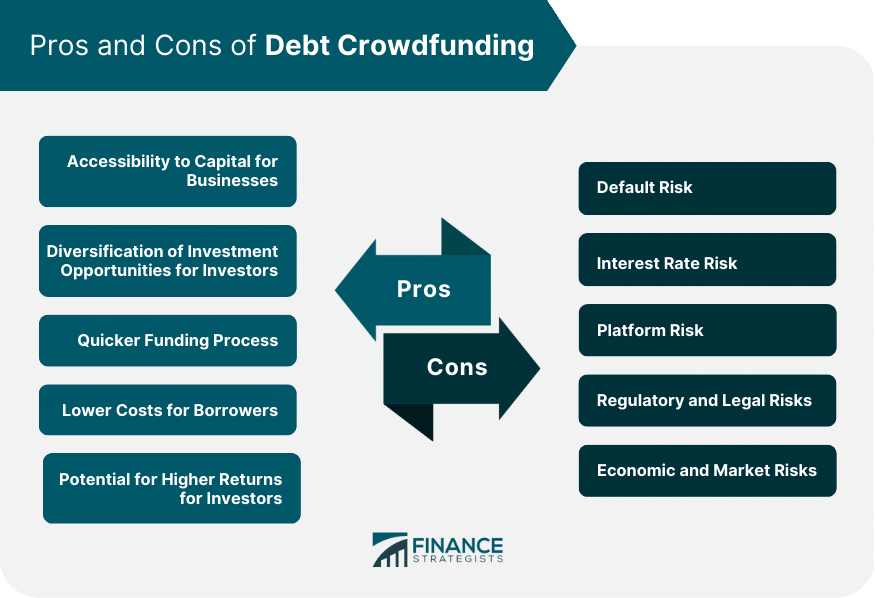

The financial landscape has witnessed a significant shift in recent years with the emergence of alternative lenders who offer affordable credit options beyond the traditional banking system. These lenders, such as peer-to-peer lending platforms and microfinance institutions, play a vital role in providing access to credit for individuals and businesses who may have been overlooked or excluded by traditional banks.

Unlike banks, these alternative lenders often have more flexible lending criteria, which allows individuals with less-than-perfect credit scores or limited collateral to obtain affordable credit. Moreover, they employ innovative approaches to assess borrowers’ creditworthiness beyond conventional measures, thereby widening the pool of recipients for affordable credit.

Impactful Examples like Peer-to-Peer Lending Platforms, Microfinance Institutions, etc.

One notable example of an alternative lending model is peer-to-peer lending platforms. These platforms connect borrowers directly with individual investors willing to lend money at competitive interest rates. By cutting out intermediaries like banks, peer-to-peer lending can offer lower interest rates on loans while ensuring a fair return for investors.

This approach has gained traction globally due to its potential for financial inclusion and accessibility. Microfinance institutions are another crucial player in providing affordable credit options to segments of society that are typically underserved by traditional banks.

These institutions offer small loans tailored for entrepreneurs and low-income individuals who lack access to formal banking services. Microfinance loans often come with reasonable interest rates and flexible repayment terms that align with borrowers’ cash flows.

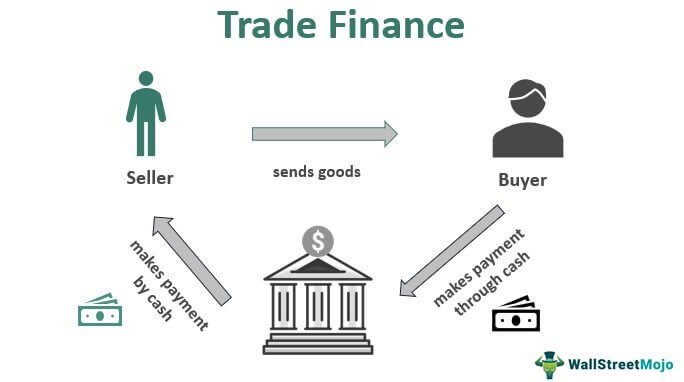

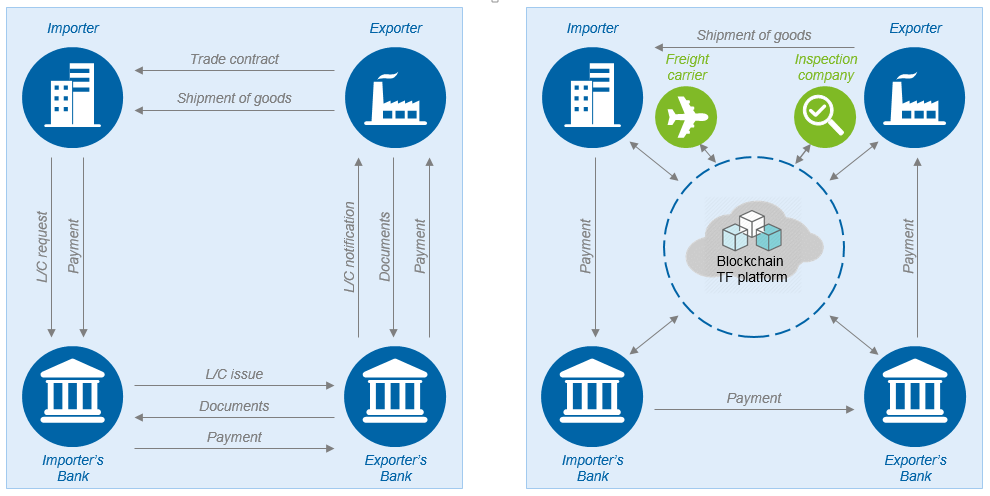

Exploration into the Use of Technology-driven Solutions like Fintech Apps for Accessing Affordable Loans

In recent years, technology-driven solutions known as fintech apps have revolutionized the way consumers access affordable loans. Fintech apps leverage the power of digital platforms and advanced algorithms to streamline the lending process, making it faster, more convenient, and cost-effective.

These apps enable users to apply for loans through their smartphones, eliminating the need for extensive paperwork and long approval processes associated with traditional banks. They also employ innovative features such as real-time credit scoring and analysis of individual financial profiles to personalize interest rates and loan terms.

Additionally, fintech apps often offer flexible repayment plans that cater to borrowers’ unique financial situations, providing them with greater control over their credit obligations. Overall, alternative lenders and fintech solutions have significantly contributed to enhancing access to affordable credit outside the realm of traditional banks.

By leveraging technology and adopting innovative approaches, these institutions empower individuals and businesses with tailored credit options that were previously inaccessible or burdened by high costs. As the financial landscape continues to evolve, embracing these alternative sources of credit becomes increasingly important in fostering financial inclusion for all.

The Role of Financial Education in Promoting Affordable Credit Usage

Importance of financial literacy programs in empowering individuals with knowledge about responsible borrowing

Financial education plays a crucial role in promoting affordable credit usage by empowering individuals with the necessary knowledge and skills to make informed borrowing decisions. Without proper understanding of personal finance and credit management, individuals may fall into the trap of high-interest loans or accumulate excessive debt, jeopardizing their financial stability. Financial literacy programs provide valuable information regarding budgeting, saving, and responsible borrowing practices.

These programs educate individuals about the importance of maintaining good credit scores, managing debt levels, and comparing loan options to secure the most affordable credit available. By imparting this knowledge, financial literacy programs empower individuals to confidently navigate the complex world of credit and make sound financial choices that enhance their long-term financial well-being.

Conclusion

Affordable credit is a vital aspect of economic prosperity as it enables individuals and businesses to access necessary funds for growth and stability. Understanding credit mechanisms such as interest rates, APRs, and credit scores is essential for identifying affordable lending options.

Government initiatives aimed at increasing access to affordable credit have made significant strides; however, alternative lenders and fintech solutions also play a pivotal role in providing convenient access to affordable loans beyond traditional banking systems. Moreover, financial education through comprehensive literacy programs equips people with the knowledge required for responsible borrowing practices.

By promoting smart financial decision-making and fostering an understanding of how credits work, we can empower individuals to attain affordablecredit while building a strong foundation for long-term financial success. Let us embrace these opportunities collaboratively to unlock economic potentials for all members of society